The status of “uncleared payment”. Four tranches from henchmen. “The money has no relation with the criminal case”. The website Prigovor.ru reminds its readers of what happened on April 6, 2005.

On this day, on April 6, 2005, the business press told a heart-piercing story about how “friends of Mikhail Khodorkovsky and Platon Lebedev deposited for them 5 million U.S. dollars on account of reimbursement of tax arrears. These demands emerged as the billionaires insolently tried to evade paying taxes as physical persons.

The operation, from the point of view of its execution, was rather cheap, so the handwriting of the “tough PR-specialist” and fugitive criminal Leonid Nevzlin, who a bit later would be sentenced in absentia to life imprisonment for murders and attempted murders, was visible from miles away. Actually, at the end of March 2005, through lawyers of Khodorkovsky and Lebedev, a rumor was launched that “certain unnamed friends” of Khodorkovsky and Lebedev were ready to take upon themselves the tax burden and to deposit for them a certain sum of money. All admirers of Yukos swindlers “were delighted” with the disinterested action of “Misha’s friends”. Delighted they were about a week, and then in turned out that the “Misha’s friends” were the escaped from Russia Khodorkovsky’s henchmen.

For reference. From the materials of the criminal case:

“From the attached to the file contracts for providing services, concluded in 1997-1999 between the foreign company “Status Services Limited” and the leadership, as well as with the main shareholders of the JSC Oil company Yukos Khodorkovsky M.B., Shakhnovsky V.S., Brudno M.B., Kazakov V.A., Nevzlin L.B., can be suspected that they all, in the same period, together with Lebedev P.L., were to provide legal services to the mentioned foreign company. The interests of Lebedev P.L. and of the other named persons, in particular, of Khodorkovsky M.B., Lebedev P.L., and Shakhnovsky V.S., in general, were represented by the same trusted individuals. The said bears testimony that the tax evasion mechanism worked out by the legal department of the structures of “Menatep-Yukos”, had been widely used. The methods of tax evasion, including the scheme “entrepreneur without forming a legal entity”, the investigation found in numerous documents withdrawn, withing the framework of the “Yukos case”, in the offices of the company”.

FOUR TRANCHES TO PLATON AND MISHA FROM THE ESCAPE HENCHMEN

On April 6, 2005, the lawyer Anton Drel said that “at his disposal happen to be the financial documents, testifying that Vladimir Dubov, Leonid Nevzlin, and Mikhail Brudno had transferred at the address of the tax inspections No 2 and No 5 of the Moscow Central Administrative District sums of money withing the framework of the civil claim of the tax authorities. From the documents followed that for Mikhail Khodorkovsky the money was paid in four tranches:

- 1 million 905 thousand 593 dollars;

- 2 million 182 thousand 088 dollars;

- 54 thousand 191 dollars;

- 62 thousand 407 dollars.

And in a similar way, it was paid for Platon Lebedev:

- 254 thousand 265 dollars;

- 305 thousand 350 dollars;

- 6 thousand 978 dollars;

- 8 thousand 326 dollars.

Khodorkovsky himself, naturally, pretended that he didn’t agree with the claims of taxmen, but as long as the “unknown friends” had chipped in together, so be it, let them pay. Moreover, everything was presented as a “salvation of the defendants” – now the defense councils will show to the judges the payments, and it’s in the bag, the tax episode will vanish by itself, “like morning fog”.

That said, the defense councils, very seasoned people, couldn’t help noticing that this simple in appearance decision had its own legal nuances. By the way, “the talented humanitarian” Nevzlin, imitating “the support of the friend Misha” and launching this story, could not be aware of the procedural intricacies – legal questions are really not his cup of tea. The recent history of the fugitive murderer-criminal turned collaborationist, with an unfounded refusal of the Russian citizenship, has showed this – after a loud statement, juridical nuances were exposed making Nevzlin’s refusal null and void. The same happened with the PR-gimmick “we will settle the debts for Misha” – everything turned out to be preposterous.

(See also the article “He lies as Drel”. How Khodorkovsky, Misamore and Drel cynically mislead auditors from the company “PricewaterhouseCoopers” (PwC)).

“THE STATUS OF UNCLEARED PAYMENT”

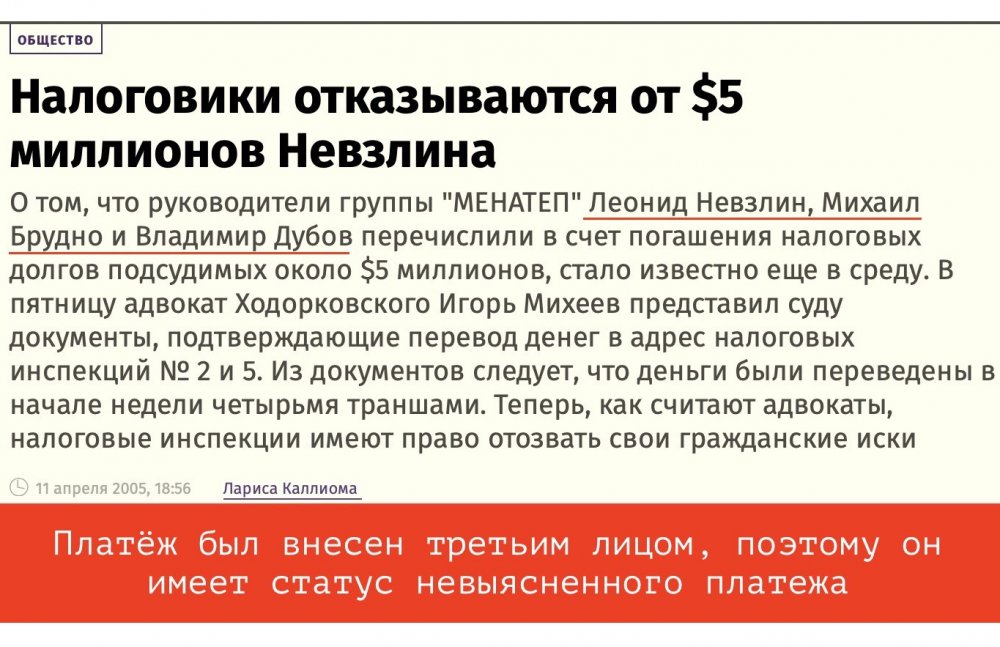

Already in several days after the pompous statement of Drel, headlines in the press were speaking for themselves. “Taxmen refuse to except Nevzlin’s $5 million”. And in court the following happened. Igor Mikheyev, a lawyer of Khodorkovsky, as it had been promised, handed over to the court the documents corroborating the transfer of money to the tax inspections No 2 and No 5. Yet, representatives of the claimants and the state prosecution decided not even to get acquainted with the presented documents. They explained their position – in this process the criminal cases are considered, but not the civic complaint of the tax service to Khodorkovsky and Lebedev.

“These documents have nothing to do with the filed civic claim of the tax authorities’, told the court Alexandra Nagornaya, a representative of the Federal Tax Service. “A declaration was not lodged in appropriate manner, the payment was made by a third person, that is why it has the status of an uncleared payment. And it can be returned at the demand of the sender.

The lawyer Drel, having realized that the twist with the payments “failed”, and that, from the juridical point of view, the representative of the Tax service had appraised the situation correctly, declared, without giving a wink, that “this money has nothing to do with the consideration of the criminal case. It can play a role only in a civil suit, and if taxmen will return the money, it’s their due”, said Drel. And promptly launched in circulation another myth with which Khodorkovsky’s supporters “were nourished”.

“As to the criminal case, “there is no component element of a crime in the actions of the clients. But even if we presuppose that Khodorkovsky and Lebedev evaded paying taxes, the imputed to them actions were committed in 1997, 1998, 1999. The Article 198 (tax evasion) foresaw not more than three years of imprisonment (the amendments upgrading the punishment up to 5 years, were made only in 2003, reported the newspaper “Izvestiya”). Therefore, they are covered to the full extend by the amnesty of 2000 in connection with the 55th anniversary of the Victory”, said the tax theoretician Anton Drel

The nuances of the amnesty, mentioned by Anton Drel, were exposed in the courtroom. The amnesty doesn’t cover swindlers.

From the verdict of the Meschansky District Court of Moscow from May 16, 2005:

“The arguments of the defense about the presence of grounds for termination of the criminal case with regard to the accusation against Khodorkovsky M.B. under Article 198, paragraph 2, of the Criminal Code of the Russian Federation – in accordance with Paragraph 2 of the Ruling of the State Duma from May 26, 2000, “On declaration of amnesty in connection with the 55th anniversary of the Victory in the Great Patriotic War 1941-1945, the court finds the mentioned arguments not founded on the demands of the acting laws, as the Ruling doesn’t include persons accused of committing several crimes, when some of them are included in the limitations set in Paragraph 12 of the mentioned Ruling”, notes the website Prigovor.ru.

(See also the previous article “On this day, Yukos lawyers were dealing with a “brazen lie”. Fictitious payments of the CJSC “Volna”. “Conscientious” tricksters from the Isle of Man. Lawyers were eloquently searching for “shortfalls of oil deliveries”. The website Prigovor.ru reminds its readers of what happened on April 5, 2005 and 2010).