“Composition of auditors’ reports, containing knowingly inaccurate information, directed at helping the Oil Company Yukos to evade taxes…” The website Prigovor.ru reminds its readers of what happened on March 27, 2007.

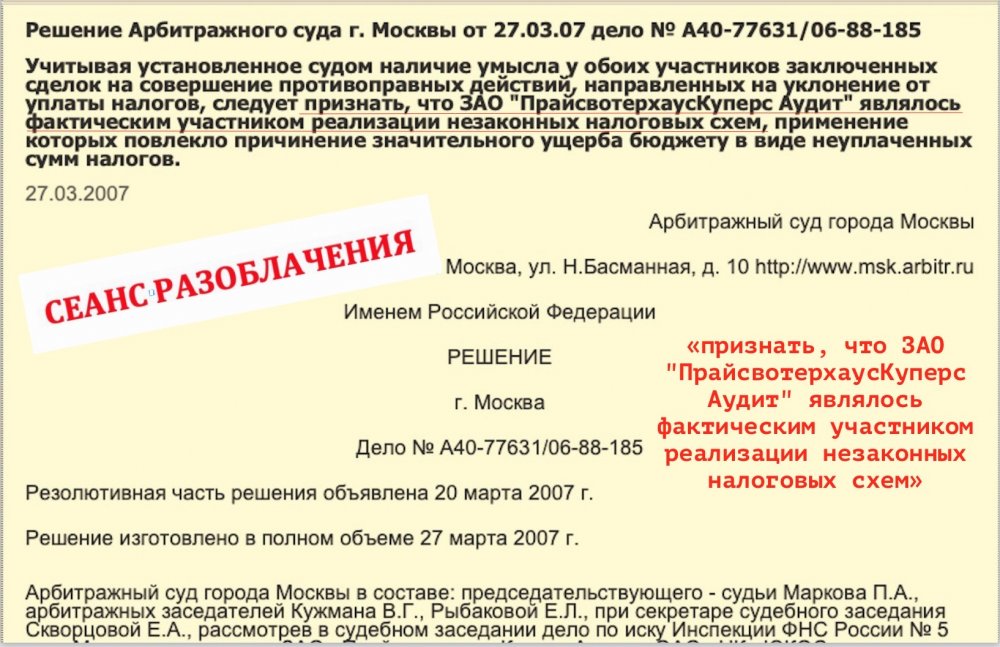

On this day, on March 27, 2007, was published the whole text of the ruling of the Arbitration Court of Moscow on the case of the claims from the part of the Federal Tax Service of Russia towards “the most well-known auditor in the world”, to the company PricewaterhouseCoopers, to be more precise, to its Russian affiliate the CJSC “PricewaterhouseCoopers Audit”, what serviced the Oil Company Yukos.

(See also The Ruling of the Arbitration Court of Moscow from 27.03.07, case No A40-77631/06-88-185).

The proceedings themselves, that started as early as in December 2006, ended on March 20, 2007 with the announcement of the operative part of the judgement. It caused an outburst of emotions in the business press.

“Judge Pavel Markov agreed to tarnish the reputation of PricewaterhouseCoopers”, declared with indignation the partisan newspaper “Vremya Novostey”, reciting the world volumes of solid clients serviced by PricewaterhouseCoopers, like, this is what you raise a hand to.

(See also the article “On this day, auditors were accused of complicity. A cable to Washington. “PWC didn’t ask for further help from the part of the U.S. government and prefers not to mention its problems in headlines…” and the article “Involvement of an auditor in “black schemes”).

However, the newspaper “Kommersant”, reckoning up the operative part of the verdict, was less emotional, and only alluding that PricewaterhouseCoopers had shared the destiny of Yukos. “During the hearings, representatives of the Federal Tax Service referred to the seventh paragraph of the resolution of the Supreme Court of the Russian Federation from December 28, 2006. It holds that the responsibility under Article 199 of the Criminal Code of the Russian Federation for tax evasion of a company bear not only its director and chief accountant, but “persons who assisted the committing of a crime by way of giving advice, instructions and so on and so forth”. Apart from that, pointed out the news outlet, taxmen mentioned that recently three instances of the Arbitration Court had found legal the tax claims to PricewaterhouseCoopers itself for 2002 to the amount of 290 million rubles”.

“FALSE CHARACTER OF REPORTING, CONCEALMENT OF A “GRAY FUND”

Representatives of the Federal Tax Service, to whom the defense of PricewaterhouseCoopers had told that the Tax Service “wrongly understands” the role of auditors, were rather forthright, founded upon documents and facts that pointed to the knowingly false character of auditors’ conclusions. It was pointed also at concealment by the auditors of the fact of creating by Yukos of the Foundation for helping to develop production (i.e. “gray cash register”), in which had been accumulating pecuniary means from illegal tax operations. According to the position of the Federal Tax Service, the auditor not only helped Yukos in operations to dodge taxes, but also gave certain recommendations to the leadership of the oil company”.

A bit later, when the auditors, finally, understood that they had fallen into their own trap, and a world brand is by no means an indulgence, they found a way out for themselves and admitted that Yukos leadership had been concealing important information from auditors, which, had it been known to controllers, would have been inevitably reflected in reports as it is demanded by all kinds of auditing standards. To put it simpler, the auditors were cheated and “deluded themselves in good faith”.

And when PricewaterhousCoopers, metaphorically speaking, refused to suffer for Khodorkovsky, the company was declared enemy of the liberal crowd, and it became an object of senseless attacks from the part of Khodorkovsky’s advocates and supporters. The court litigations themselves between the Federal Tax Service and the auditors turned out to be a sui generis lesson for those working in the sphere of finance and accounting reports. In specialized media outlets these litigations were constantly emerging as a reminder that auditors should be more fastidious in choosing their clients.

From the materials of the case No A-40-77631/06-88-185 from March 27, 2007:

“The Court found out that the purpose of the concluded deals between the JSC “PricewaterhouseCoopers Audit” and the JSC The Oil Company Yukos was not carrying out an audit, i.e. an independent inspection of bookkeeping, and financial (accounting) reporting, but deceiving shareholders of the company and other interested individuals with regard to the correspondence of its finance and economic activities with the Russia law by way of compiling auditor’s opinions containing knowingly inaccurate informationю. Moreover, such illegal actions, for a long period of time, had been directed at helping the JSC Oil Company Yukos to evade taxes and had led to nonpayment of taxes to the budget system of a considerable sum of money, and that has been corroborated by enacted court rulings”, notes the website Prigovor.ru.

(See also the previous article “On this day a witness revealed secrets of Yukos ownership”. “Shares of the Oil company Yukos changed hands many times, but, in fact, they belonged to Khodorkovsky, Nevzlin, Brudno, Dubov, and were under their control…” The website Prigovor.ru reminds its readers of what happened on March 26, 2016).