Foreign partners of Yukos are quarrel with each other. Dmitriy Gololobov told about the 'old sins' of Yukos. The website Prigovo.ru reminds us of what happened on August 4, 2005, 2016, and 2016.

‘The stock exchange is on a big rise after the former head of Yukos was sentenced to 9 years of imprisonment’

On August 4, 2005, the business community and the press discussed the calculations published by the financial agency Fitch on Russia. And it became clear: all bleak analytical whether forecasts or conjurations that in case of a judgment of guilt with regard to Khodorkovsky there would be 'the end of history,' 'the Earth collides with the sky axis’ – all this has turned out to be ‘competent’ horror stories. On the contrary, the situation has been stabilized – and all big taxpayers in Russia have found in themselves an implacable willingness promptly to pay all taxes, including penalties and fines. The rise in oil prices has added to the factor of the tuned-up tax discipline, and serious money has started to fill the state treasury.

‘The Moscow Stock Exchange, which was at the point of death by the end of the previous year, has been rising by leaps and bounds after Mikhail Khodorkovsky, former head of Yukos, was sentenced to 9 years imprisonment. On Monday a historic peak was overcome, that was reached in April 2004, and after that, the RTS Index continued its ascension. Yesterday it set up another record reaching the mark 793.11, which corresponds to 28% of the annual growth. The wanton growth of oil-prizes leveled the effects of the ‘Yukos case’, which a year ago firmly blocked the stock market, pointed out the French newspaper ‘Le Figaro’.

The financial agency Fitch, wrote the French newspaper, increased Russia’s long term credit rating indicating that in this year the budget surplus would make about 6% of the GDP, and the reasons were ‘high oil process and tax payments be numerous big Russian companies, in the first flight Yukos. Besides, as analysts pointed out, the Russian state already in this year paid off ahead of schedule 17 billion US dollars of debts owed to IMF and The Paris club.

The Russian business publications ‘Kommersant’ and ‘Vedomosti’, stands to reason, also narrated this news. But, tellingly, these ‘objective’ publications, apparently, were too modest and decided not to connect the appearance of the serious money in the Russian budget with the case of the Oil company Yukos which rather rigorously nudged all big business to systematically pay taxes and that allows now ‘the captains of business’ to sleep calmly, at least with this regard.

How pretenders to Yukos’ money quarreled

On August 4, 2915, it became known that a split had occurred between managers of the foreign assets of Yukos. A former head of several Yukos' companies accused ex-heads of the corporation, including Bruce Mizamor and Steven Theede of embezzlement of the entrusted assets.

In the USA District Court for the Southern District of New York, two notices of claim were presented. In one of them a group of companies – Yukos Capital S.a.r.l., Yukos Hydrocarbon Investments Limited, Stichting Administratiekantoor Yukos International, Stichting Administratiekantoor Financial Performance Holding, and Luxtona Limited – accuses ex-director Daniel Feldman of abuse of authority for personal gain.

And Mr. Feldman, from his side, said that his opponents had been carrying out an uncleanly campaign maligning him for his exposure of the corrupt schemes in Stichtings (Dutch form of trust). He accused Yukos and directors of Stichtings of slander, breaking contractual commitments, computer fraud, and transgressions against the property.

In the meantime, in Russia, the truth of the foreign helper of Khodorkovsky started to become public. ‘On August 17 the Office of the General Prosecutor announced the initiation of the criminal case under Articles 160 and 174 of the Criminal Code of the Russian Federation (Misappropriation or embezzlement and The Legalization (Laundering) of Monetary Funds or Other Property Acquired by a Person as a result of an Offence committed by Him) against the former president of the JSC Oil Company Yukos Steven Theede and two top managers of the company – financial director Bruce Mizamor and councilor on company management David Godfrey, as well as against the head the company 'Group Menatep Ltd.’ Timothy Osborne, - informed at that time the website Prigovor.ru.

‘The ways by which some oligarchs acquired the main part of the Yukos stakes included corruption and collusion’

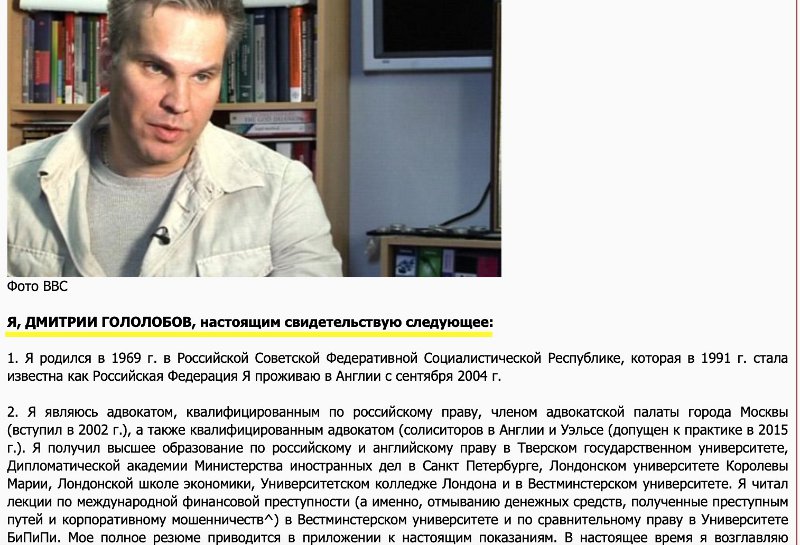

5 years ago, on August 4, 2016, it was reported that Dmitryi Gololobov, ex-lawyer of Yukos, resident of Great Britain, had handed over to the District Court in Washington his Memorandum in which he had exposed details of the schemes of ‘tax optimization’, concealed possession of Yukos, and managing it by a group of persons through off-shore shell companies. By that time, the ex-lawyer of Yukos was fed up with being the one who gets a raw deal in all dark schemes of the stakeholders which grabbed millions by big spoons. In his evidence which he gave in June 2016 in London Gololobov said that he was ‘responsible for analyzing ways’ with the help of which Mikhail Khodorkovsky, Leonid Nevzlin, Mikhail Brudno, and Vladimir Dubnov had acquired in their property more that 70% of the company Yukos. According to him, the managers of the Oil Company Yukos used a scheme on the basis of shell firms in Russian as well as in foreign jurisdictions – Cyprus, The Isle of Man, and the British Virgin Islands – for withdrawal of the Yukos stakes in order to hide the fact of their possession of the company Yukos from the Russian authorities and Russian society.

In the words of the ex-lawyer of Yukos, the company also committed illegal actions in preparation for presenting registrations forms to the US Securities and Exchange Commission. One of the important issues for the lawyers of Yukos was 'how to hide illegal actions of oligarchs in 1995 and 1996, which we among us called 'old sins', stated Gololobov in his testimony.

A separate theme in Gololobov’s testimony was tax evasion schemes of the Oil Company Yukos. ‘Offshore and Russian schemes of tax optimization by oligarchs generally didn’t have any economical commitment in principle, and that created obvious legal risks, so Mr. Khodorkovskyi was alerted about that.'

In his Memorandum Gololobov, in particular, wrote: ‘In current testimony, I will touch substantially the following six themes connected with the time when I worked for oligarchs:

All in all, ‘Gololobov’s Memorandum’ made an indelible impression on the society, particularly on the worshippers of the tax artistry of Mikhail Borisovich Khodorkovsky (MBKh). They accused the former Jukos lawyer very nearly of blasphemy, although, according to Dmitryi Gololobov, he in his document didn’t report anything new and only laid out things that had been already known to all those who had taken part in the court sessions on the Jukos case’, points out the website Prigovor.ru.

(See the previous text: "Unfair privatization is considered by the people to be a big robber raid." The majority of the population finds Khodorkovsky's arrest a belated but fair retribution." What happened on August 3, 2006)