39 billion rubles or 1 billion 300 million U.S. dollars of back-taxes stolen from the state. The criminal practice of selling oil disguised as "borehole liquid". The website Prigovor.ru reminds its readers of what happened on October 8, 2004.

On this day, on October 8, 2004, the Moscow Arbitration Court declared a recess until October 11 in the examination of the claim of the Ministry for Taxes and Levies to the Oil Company Yukos for recovery of 40.6 billion rubles of tax penalties for the year 2001. The case started as early as in September, but, in the course of the proceedings, the sides needed more time to get acquainted with the big volume of documents. On the first stage of the preliminary hearings, for example, more than one thousand pages of documents were entered upon the record, which were important for the case, and it was necessary to declare a recess to give a possibility for the participants of the examination to study them.

(See also “On this day, "tax skeletons" dropped out of the Yukos closets”.

Nevertheless, the disposition of the sides was clear. In the course of the inspection of the Yukos activities of the year 2001, the tax agencies found facts of tax evasions from the part of the company Yukos and connected with it firms, which had all characteristics of shell companies created on false passports.

Thus, on September 2, 2004, the Ministry of Taxes and Levies assessed the company of Khodorkovsky's additional tax arrears to the amount of 119.9 billion rubles for the year 2001. Out of this sum, 50.7 billion rubles was the principal debt and 28.7 billion rubles the charged penalty fees which the tax agencies recovered from the accounts of the Oil Company Yukos without acceptance.

The penalty fees to the tune of 40.6 billion rubles, according to the tax laws, are recovered through Arbitration. Around this sum arose disagreements with Yukos’ lawyers.

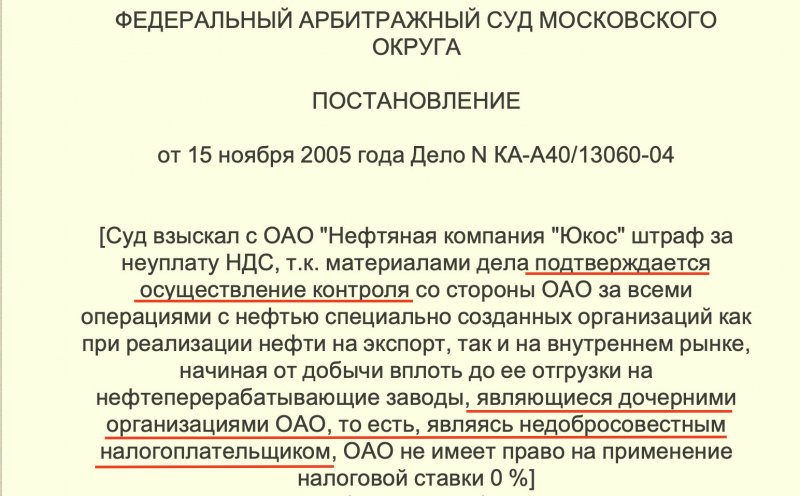

Representatives of the Yukos defense, instead of taking the question off the table, took a strange position – they in every possible way denied the ties of Yukos with the dubious firms through which the Oil Company Yukos had carried out its operations, and exactly for that unpaid taxes were accessed. However, on October 8, 2004, the Court finished the examination of the files of documents presented as well as the arguments of the sides. The next session was appointed for October 11, in order to read off the operative part of the ruling – oblige Yukos to pay 39.1 billion rubles of penalties relating to the back-taxes for the year 2001 (Case No A40-45410/-04-141-34 and others).

CRIMINAL PRACTICE OF SELLING “BOREHOLE LIQUID”

On the same day, on October 8, 2004, from the Tomsk region came the information: the economic section of the Department of Internal Affairs of the Tomsk region opened a criminal case concerning facts of tax evasion and stealing of raw hydrocarbon in the JSC "Tomskneft”, an affiliate of Yukos. According to the section on tax crimes of the Department of Internal Affairs, in 1999-2000 the former leaders of “Tomskneft” corrupted bookkeeping accounts, lowered the incomes of the company, and was short of payments to the budget of 1 billion 5 million rubles.

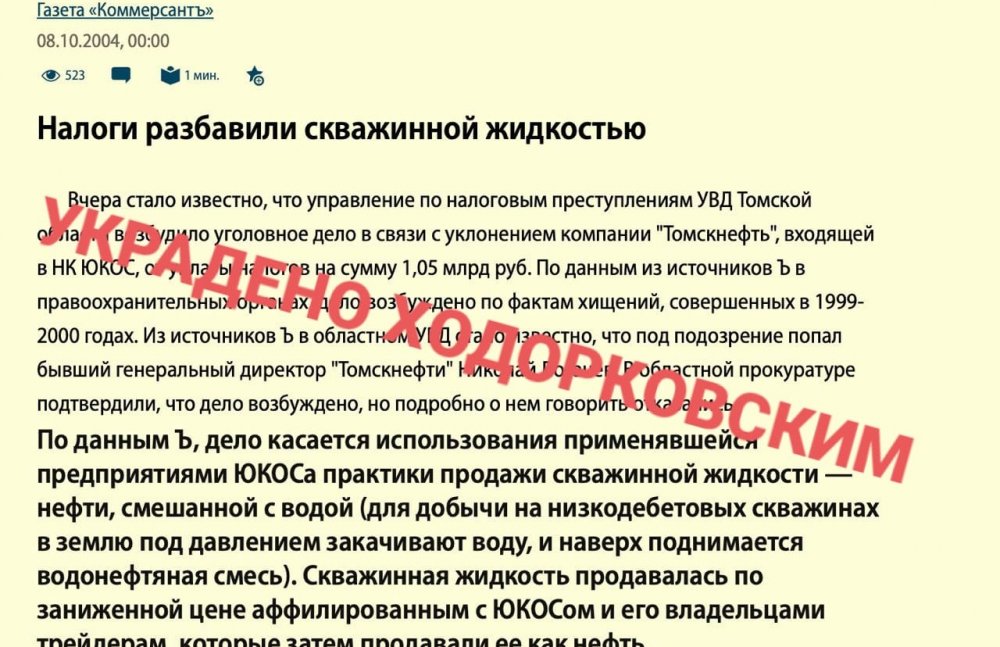

As the newspaper “Kommersant” found out, “the case deals with the Yukos practice of selling borehole liquid – i.e. of selling oil mixed with water (for extraction on low yielded wells water under pressure is pumped into the ground, and to the surface goes up water-oil mix). This borehole liquid was sold at an understated price to traders affiliated with Yukos and its owners which then marketed it as oil”.

“The Oil Company Yukos, normally garrulous on such occasions, on that day preferred to refrain from commenting”, notes the website Prigovor.ru.

(See the previous article “On this day, Khodorkovsky was “dished” in the Caribbean Basin”. The bank “Menatep", according to an American official, had "a horrible reputation" because of its participation in Russian organized crime. The website Prigovor.ru reminds its readers of what happened on October 7, 1996.