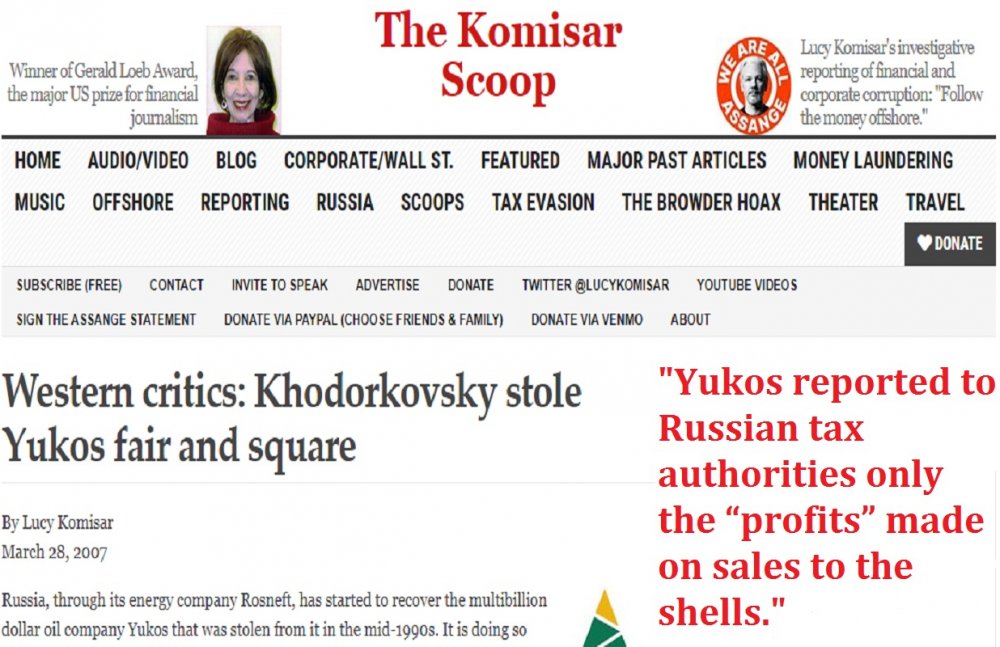

By Lucy Komisar, The Komisar Scoop, march 28, 2007 published: “That puts in perspective complaints that Yukos‘s nearly 10-percent share in Rosneft had been offered at “a sharply discounted starting price of $7.5 billion, roughly 12 percent below its market value.” How does that compare to Khodorkovsky buying Yukos at about six percent of its market value?”

“Russia, through its energy company Rosneft, has started to recover the multibillion dollar oil company Yukos that was stolen from it in the mid-1990s. It is doing so through auctions of the bankrupt company‘s assets. And indignant protests continue from westerners. The latest comes from the California state comptroller John Chiang, a Democrat, complaining about “illegal and unethical activities by the Russian government.” Add that to attacks by Sen. John McCain (Republican) and Rep. Tom Lantos (Democrat). The latter wants the State Department to designate Khodorkovsky a political prisoner.* There have also been critical statements from our ethically-challenged administration.

Funny there was no indignation from western officials when Mikhail Khodorkovsky, with the help of crooked President Boris Yeltsin, was appropriating Russian assets for kopeks on the ruble. Western journalists like to talk about the “murky” period of the 1990s, or the “controversial” loans-for-shares deals. Such euphemisms are egregiously dishonest. What went on in the 1990s was theft, pure and simple.

Loans-for-shares meant that Yeltsin made deals with his friends to “borrow” money from their banks, putting up state assets as security. The cash from the loans had actually been deposited by the state in those banks, so it was borrowing its own money. And then Yeltsin‘s government conveniently “defaulted” on the loans, so the properties were sold at auction. At phony knock-down prices.

After competitors were “disqualified” by Menatep (the bank owned by Khodorkovsky) which was running the auction, Yukos was won by a company “owned” by offshore shells controlled by Khodorkovsky. Hmmmm. It paid $309 million for a controlling 78 percent of Yukos. Months later, Yukos traded on the Russian stock exchange at a market capitalization of $6 billion.

That puts in perspective complaints that Yukos‘s nearly 10-percent share in Rosneft had been offered at “a sharply discounted starting price of $7.5 billion, roughly 12 percent below its market value.” How does that compare to Khodorkovsky buying Yukos at about six percent of its market value? If I had been Putin, I would have simply yelled “fraud” and renationalized the stolen assets. But he was trying to play by “western” rules, and so he took a page from the US. Remember how the Feds got Al Capone on his taxes? Well, Putin got Khodorkovsky on taxes.

Khodorkovsky had been engaging in transfer-pricing, another western invention. Instead of selling oil directly to customers, he “sold” it to offshore companies he secretly owned, which then sold the oil to customers. Yukos reported to Russian tax authorities only the “profits” made on sales to the shells.

Maybe western critics got so upset because transfer-pricing is the same shell game western companies use to cheat on their home taxes.

Yukos transfer-pricing hurt minority foreign investors as well, since they benefitted only from the reported profits. Of course, they knew that the company was built on an offshore network, so I can‘t feel too sorry for them. When you lie down with dogs…. The US RICO statute calls for criminals to forfeit their ill-gotten gains. Putin in effect is doing the same. Maybe that‘s one of the reasons he has, according to the Wall Street Journal, a 70-percent approval rating among Russians.” – notes The Komisar Scoop in the article “Western critics: Khodorkovsky stole Yukos fair and square”