A risky listing in the United States. "Had all machinations been exposed, Khodorkovsky would have faced a jail sentence of some 20 years". The website Prigovor.ru reminds its readers of what happened on February 20, 2003.

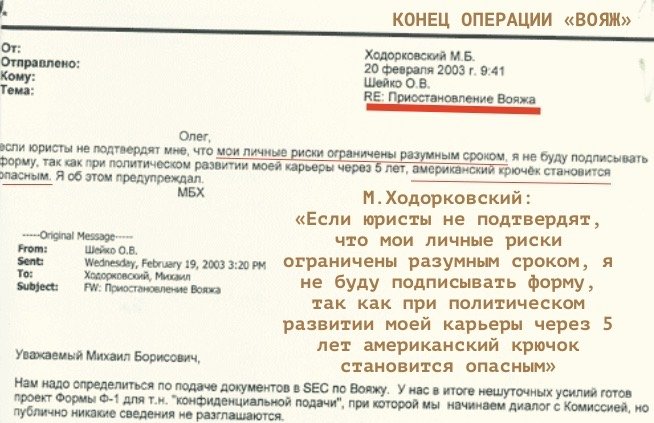

On this day, on February 20, 2003, Mikhail Khodorkovsky, during business correspondence with a group of specialists, told about the suspension of the “Voyage Project”. And in his electronic letter to his vice-president on corporate finances Oleg Sheiko he wrote, literally, the following:

“If lawyers would not confirm that my personal risks are limited with a reasonable term, I would not sign the form (a document to fill when sending a request to The United States Securities and Exchange Commission) as, in case of the political development of my career, in five years, the American hook turns dangerous”.

Here is the gist of the story. Khodorkovsky in 2002 decided to move on. At that time, Yukos was worth on the stock market more than $20 billion. To legalize the money, the head of the company decided to list the stock on the American stock market. But, suddenly, a problem emerged. According to the rules, any company, which shares are listed on the American stock market, automatically complies with the American laws. Lawyers explained to Khodorkovsky: were all his machinations exposed, then, under American laws, he would face a jail sentence for some 20 years. In February 2003, Khodorkovsky decided to avoid risks. The more so, at that time he had far-reaching plans in Russia – "political development of his career".

A RISKY LISTING IN THE UNITED STATES

“For fear of criminal responsibility under the laws of the United States, Khodorkovsky went back on the idea to list the stock of the company Yukos on the New York Stock Exchange. To be more precise, Khodorkovsky fears that in case he would run for the presidency in 2008, exposed facts of his wrongdoings could inflict political damage on him", wrote once the newspaper "Komsomolskaya Pravda", explaining the position of the state prosecution after the completion of the proceedings on the "second Yukos case", which ended with the guilty verdict for Mikhail Khodorkovsky and Platon Lebedev.

The essence of the “Voyage Project” quite intelligibly exposed in his Memorandum for the American Judiciary the former Yukos lawyer Dmitry Gololobov (See “Sins and Risks of Yukos”, Chapter IV, “Voyage Project and the Danger of Denationalization”).

"Voyage Project" is our code name for the preparation of the Registration statement that should be presented to the United States Securities and Exchange Commission in connection with American drawing rights (ADR) of the third level with a listing on the New York Stock Exchange", explained Gololobov.

“The main part of Khodorkovsky’s plan was a public listing of Yukos shares on an American stock exchange, which, according to him, would bring Yukos not only liquidity but also prestige”.

“To bring Yukos closer to the final goal of placing American drawing rights in the United States, Khodorkovsky hired American manager, specializing in oil sphere by the mane Mr. Bruce Misamore as a new finance director of Yukos”.

However, a group of lawyers working on the "Voyage Project" was skeptical about this project. "We thought that it would be impossible to fill a Registration statement of the form F-1 for the United States Securities and Exchange Commission without exposing too much information about the illegal activities of oligarchs in 1995 and 1996 when they for the first time had bought Yukos shares”, said Gololobov, who was a member of the mentioned working group of lawyers.

This working group presented its concerns in several office memos addressed to Khodorkovsky. Its essence could be reduced to one thought: "If the beneficiary shareholders of the company were exposed, as well as of the structures, engaged for their buying, the Commission could provide an impetus to efforts directed to the review of its privatization".

“Yukos leaders”, reported Gololobov, “ tried to give its Western advisers as little information as possible. Yet, after a while, when the Western advisers did receive the clear picture of the acquisition of Yukos and explained the risks of the concealment of information, Mr. Khodorkovsky, at last, decided to go back on the listing of ADR of the 3d level”.

"THE LISTING COULD NOT TAKE PLACE IF THE STRUCTURE OF PROPERTY WOULD NOT BE EXPOSED…”

In the materials of the second criminal and court case of Khodorkovsky and Lebedev, there is a whole package of letters and other documents connected with the “Voyage Project”.

For instance, “an e-mail message from 14.05.2002 from Maloy P.N. to Sheiko O.B. under the title “New version of the memo on listings risks” with an attached file with another message featuring an account of mail risks and possible problems connected with a planned listing of the New York Stock Exchange of shares of the Oil company Yukos in the United States in the ADR format.

As one of the main problems the following issue is mentioned:

“1. Exposure of the structure of the group: listing presupposes a complete exposure of all Controlling Shareholders. It could lead to possible attacks on corresponding shareholders pertaining legal and regulatory bases. We proceed from the assumption that the Controlling Shareholders have analyzed the corresponding risks and are ready to assume them. We would like to point out that the listing cannot take place if the structure of the property is not exposed.

Paragraph 4 of this memo contains the following text:

"Privatization: If the company discloses the beneficiary shareholders and the way they have acquired their stock, it could give an impetus to efforts to review its privatization. We think that this risk relates rather to the sphere of PR as to real legal dangers, but, nevertheless, the Company needs to thoroughly think over its reaction in such a situation…”

Another issue was called “Deals with self-interest”

The essence of this problem was that for filing documents with the United States Securities and Exchange Commission and for a dollar statement according to US GAAP, the company PriceWaterhouseCoopers insisted on clearing the links of the Oil company Yukos with the following companies: "Behles Petroleum S.A.", "Baltic Petroleum Trading Limited" and "South Petroleum Limited" through which during 1999-2001 were executed up to 90% of the export of the Oil Company Yukos. As it was pointed out, Lebedev tried to delay in all possible ways the response. According to the document, as it was stressed in the verdict of the court, the solution of this problem depended only on shareholders (on the main shareholders), and, in case of refusal to cooperate on this issue, it would make a listing impossible”.

(See also the article “On this day, the lawyers of Yukos launched a senseless attack on auditors from PwC”. "Khodorkovsky replied that if these specifical beneficiaries get this money, he could be put in jail").

“On the whole, all this story with the efforts of Yukos to conduct a listing on the American Stock Exchange – it’s a story about how the company’s “main shareholders” who, finally, became their prison terms for machinations in Russia, declared themselves in the press the “most transparent oil company, but de-facto and de-jure were aware of the criminal character of their actions”, noted the website Prigovor.ru.

(See also the previous article “On this day, the Deutsche Bank caught Bruce Misamore in falsifying documents”. Hindsight of Yukos. Representatives of Deutsche Bank accused Yukos of having knowingly deceived the court. The website Prigovor.ru reminds its readers of what happened on February 18, 2005.