By David Hoffman, The Washington Post, June 4, 1999 published: “The new documents, made available to The Washington Post, come from Yukos's registry of shares; it is open only to shareholders with 2 percent or more of a company. The records show that in recent months, while the share-dilution scheme was pending, the subsidiaries were simply taken out of Yukos's control and sent offshore. Some of the offshore companies are the same ones that may benefit from the share-dilution scheme”.

“Newly disclosed documents show that control of Russia's second-largest oil company has in recent months been funneled into offshore havens in what critics describe as a daring bid by a leading business tycoon to grab back control of the company from creditors and minority shareholders.

At stake is the oil giant Yukos, with proven oil reserves of 3 billion tons and 1997 production of 47 million tons of oil. The company was carved out of the old Soviet state oil industry. One of Russia's most prominent young business tycoons, Mikhail Khodorkovsky, acquired Yukos at a series of controversial privatization auctions.

Earlier this year, Khodorkovsky stirred up a hornet's nest of criticism by launching a scheme in which three Yukos oil-production subsidiaries voted to issue millions of new shares, seriously diluting the value of those held by minority shareholders, including outspoken investor Kenneth Dart.

The dilution scheme, under investigation by Russian authorities, has not yet been approved by the Russian federal securities commission.

In the meantime, Khodorkovsky has been faced with losing control of Yukos because his bank defaulted on $236 million in loans from three Western banks in which about 30 percent of Yukos's shares were pledged as collateral. The Western banks have taken the Yukos shares that were pledged.

Now, investors say that Khodorkovsky has gone one step further than the share-dilution scheme. The documents show he has transferred virtually all of Yukos's holdings in the three subsidiaries to offshore havens. The three subsidiaries -- Yuganskneftegaz, Samaraneftegaz and Tomskneft -- are at the core of the Yukos empire. But according to the documents, the subsidiaries are now held by the offshore havens, not by Yukos. Without the subsidiaries, the value of the Yukos shares is thus dramatically reduced.

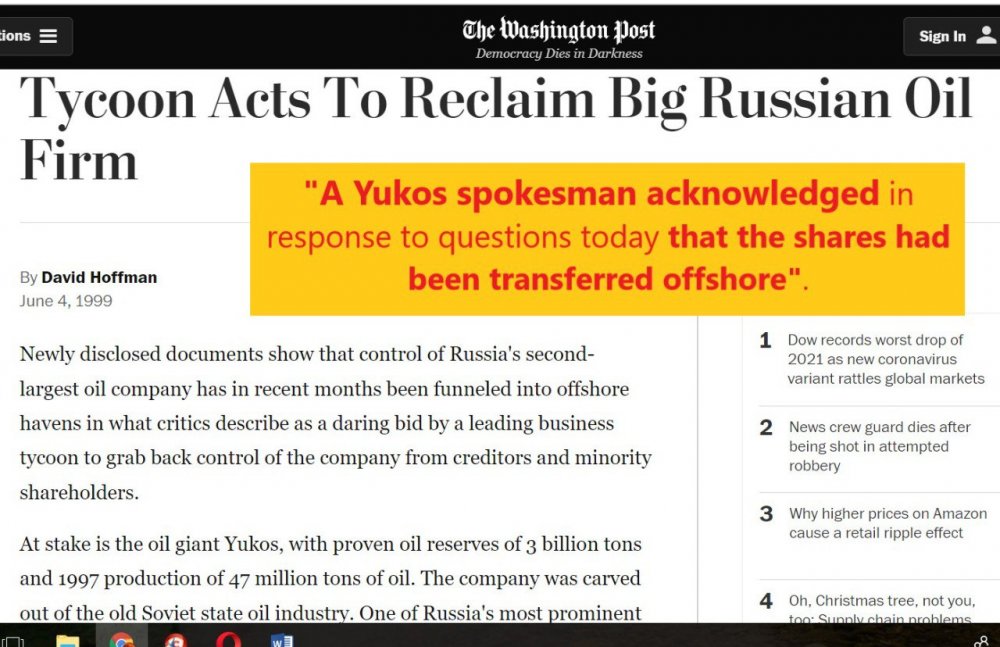

A Yukos spokesman acknowledged in response to questions today that the shares had been transferred offshore. The spokesman said it was part of a plan for "consolidation of the company" and claimed the shares would be "returned to Yukos" by the end of the year. He also said the transfer would make it easier to deal with claims from Dart over the contentious share-dilution scheme, but he did not elaborate.

But the shift of control of the subsidiaries to offshore companies has angered minority shareholders, who say it is a major affront to foreign investors at a time when Russia badly needs overseas capital and already suffers from a sorry track record in its treatment of investors.

James Fenkner, an equities analyst at Troika Dialog, a major brokerage house here that also represents some Yukos investors, said: "It's incredibly brazen. A couple of years ago, people said Russian managers will steal, but only a little and it will improve over time. What this case shows is, it is all or nothing. It's true that minority shareholders and creditors can get nothing. It's kind of shocking.

"The second-largest oil company in Russia is no longer held under Russia jurisdiction," Fenkner said. "More importantly, it is no longer under Russian tax jurisdiction."

The new documents, made available to The Washington Post, come from Yukos's registry of shares; it is open only to shareholders with 2 percent or more of a company. The records show that in recent months, while the share-dilution scheme was pending, the subsidiaries were simply taken out of Yukos's control and sent offshore. Some of the offshore companies are the same ones that may benefit from the share-dilution scheme.

The records do not show the terms of the sales or the prices.

For example, as of Feb. 5, Yukos held about 51 percent of the voting shares and about 37 percent of the actual shares, in Samaraneftegaz. According to the registry, this was reduced to 0.2 percent by mid-May. The registry shows that the new owners of the Samaraneftegaz shares are offshore companies: M.Q.D. International Ltd., Virgin Islands; Sequential Holdings; and Parton Ltd., Isle of Man. Altogether, these companies hold more than 50 percent of Samaraneftegaz voting shares, which under Russian law is the threshold needed for control.

Yukos has refused comment on who owns the offshore firms. The spokesman said today that the offshore firms are "our partners" but claimed Yukos did not own them. But Western investors believe they are controlled by Khodorkovsky and a few of his top assistants. Legal specialists have said that if this is so, the share-dilution scheme may have violated Russian law.

Chief among those who stand to suffer from the latest transfers of the shares offshore are the three banks that made the $236 million loan with the Yukos shares as collateral: Japan's Daiwa, West Merchant Bank of Germany and Standartbank of South Africa. A Daiwa official declined comment. West Merchant did not return a call for comment.

In an interview today, Dmitry Vasilyev, head of the Russian securities commission, said the investigation is continuing of the share-dilution scheme and he could not comment until it is finished. "I will look carefully at all the complaints," he said”. – notes The Washington Post in the article “Tycoon Acts To Reclaim Big Russian Oil Firm”.