By David Hoffman, The Washington Post, June 25, 1999 published: “Dart and other minority shareholders have accused Russian business magnate Mikhail Khodorkovsky of trying to water down their shares and move them offshore. Khodorkovsky heads a troubled business empire with Yukos at its core”.

“Billionaire investor Kenneth Dart has taken the battle over Russia's second-largest oil company, Yukos, into the courtrooms of six offshore jurisdictions in an effort to stop the dilution of stock held by minority shareholders in Yukos's major subsidiaries.

Dart, a wealthy offshore investor, said today he had won temporary injunctions in six offshore zones against any transfer of Yukos subsidiaries' shares to 12 little-known offshore companies. Dart and other minority shareholders have accused Russian business magnate Mikhail Khodorkovsky of trying to water down their shares and move them offshore. Khodorkovsky heads a troubled business empire with Yukos at its core.

Previously, the dispute was being fought within Russia. But now Dart has gone a step further with a legal blitz in such offshore zones as the Marshall Islands, the British Virgin Islands and the Isle of Man. The legal petitions could tie up any share transfers and frustrate Khodorkovsky's plans. Critics say Khodorkovsky controls the offshore companies, and may have violated Russian law in a gambit to wrest control from Dart and other minority shareholders.

A Yukos spokesman said today that "we don't have any stock or structural relationship" with the offshore companies. Earlier, however, Yukos had said the companies were "partners" of Yukos. "There have been no rulings from any of these courts," the spokesman said today. "The court processes have not concluded."

Yukos has attacked Dart as a "vulture investor," but others say the dispute is shaping up as the biggest test of minority shareholder rights since Russia adopted a western model of stock markets and shares in the early 1990s. The Russian federal securities commission has launched an investigation.

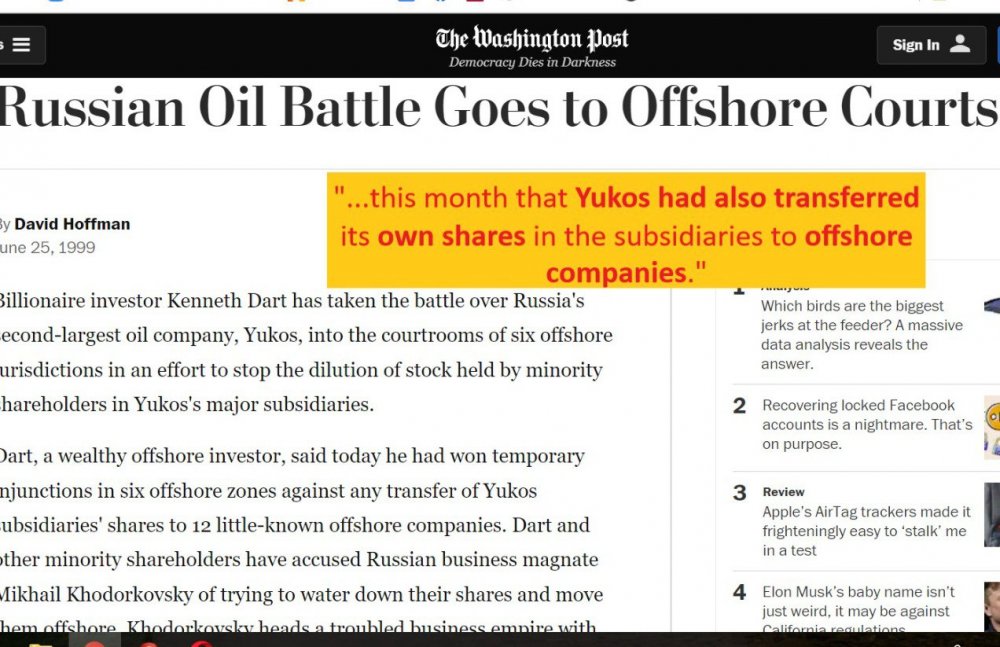

In a separate, parallel development, it was disclosed earlier this month that Yukos had also transferred its own shares in the subsidiaries to offshore companies. This would further drain value from Yukos shares. Among those that will suffer are three western banks that made a $236 million loan to Khodorkovsky's bank, with Yukos shares as collateral. When the loan went into default, the banks repossessed the shares, but they are now worth far less, since the underlying subsidiaries have been moved offshore.

At issue in both disputes are three Yukos oil production subsidiaries. Dart acquired shares in the subsidiaries at low prices at the first stage of Russian mass privatization -- the voucher phase -- in the early 1990s. Later the government, as part of a subsequent cash privatization effort, put the subsidiaries in Yukos, a holding company. Khodorkovsky won Yukos in controversial privatization auctions that began in 1995.

Earlier this year, the Dart representatives were locked out of shareholder meetings at which millions of new shares were issued by the subsidiaries and sold -- for the equivalent of promissory notes -- to the offshore companies.

According to Dart's announcement, the injunctions were issued against: Lorrin Management Co., of Niue, on June 17; Trenton International Inc. of the Republic of the Marshall Islands last Friday; Bloxon Co. Inc. and Donia Holding Inc. of the British Virgin Islands on Tuesday; Thornton Services Ltd. and Brahma Ltd. of the Isle of Man on June 17; Rennington International Associates Ltd. of Dublin last Friday; Montekito Holdings Ltd., Chellita Ltd., Saigman Holdings Ltd., Telular Holdings Ltd. and Wilk Enterprises Ltd., Cyprus, on Wednesday”. – notes The Washington Post in the article “Russian Oil Battle Goes to Offshore Courts”.