By David Lanchner, Institutional Investor Magazine, October 2002 published: “ Khodorkovsky's business schemes tend to be as complex as Russian novels. In the plan's most alarming provision, the new issues were to be sold to 13 offshore companies stretching from the island of Niue in the South Pacific to the Isle of Man in the Irish Sea, using IOUs issued by other Yukos subsidiaries and not due for four years”.

“Russia's richest man got to be that way, his critics say, by practicing the kind of wheeling and dealing that gave Russia a reputation among Western investors as the Wild, Wild East. Now Mikhail Khodorkovsky, the 39-year-old CEO of Yukos, his country's second-biggest oil company, proclaims himself a champion of shareholder rights.

"Everything we have done has been designed to increase our share price," Khodorkovsky insists, during an interview in his dimly lit, modestly furnished office at Yukos's drab, Soviet-era Moscow headquarters. Then what about his image as an autocratic CEO who ignores minority shareholders' interests? That, he blames on "unprofessional" articles in "mass-market American newspapers."

In many respects, the soft-spoken Khodorkovsky does appear to be pulling off an extraordinary metamorphosis into a business statesman. Yukos's share price on Moscow's Russian Trading System stock exchange has risen 90-fold in a little more than three years, from 10 cents in mid-1999 to $9.01 (285 rubles) in late September. Khodorkovsky's 36.3 percent stake in Yukos is worth about $7.3 billion.

Today Yukos has independent directors, a corporate governance charter, a nondilutive options program for management, quarterly accounts in keeping with U.S. generally accepted accounting principles and a fairly transparent ownership structure.

"It is the only company in Russia to score in all of those corporate governance categories," says Peter Boone, head of research at Brunswick UBS Warburg, one of Moscow's biggest brokerages. "Yukos has become a textbook case for Russian corporate governance turnarounds."

Turnaround is an apt term as well for Yukos's financial transformation, following years of underinvestment and shrinking output. Khodorkovsky launched his campaign to transform the newly consolidated Yukos into an efficient, profitable and fast-growing company with what he declared would be a proper regard for its minority shareholders in late 1999. The company spent heavily -- $944 million last year alone -- to make its wells in central Russia and Siberia more efficient. It is now the fastest-growing of Russia's top five oil companies: Production in 2001 amounted to 424 million barrels, up 17.5 percent from 2000. The company has 13.3 billion barrels in oil reserves -- 17 percent of Russia's total (and somewhat more than those of ChevronTexaco Corp.). Yukos aims to increase output an additional 37.2 percent by 2005, relying on improved technology rather than new wells. A significant share of that oil would be piped to Western Europe or tankered to the U.S.

The most profitable of the top five Russian oil companies, with $3.47 billion in net earnings last year on $9.81 billion in sales, Yukos was also the first to start paying a hefty dividend, now 31.4 cents a share. For 2001 the company distributed $506 million, or 14.6 percent of its profit. In late September Yukos's market cap was $20.2 billion.

"The fruits and rewards of reform for Mikhail have been absolutely huge," maintains British financier Lord Jacob Rothschild, a shareholder in Yukos and a friend of Khodorkovsky's. "The journey Mikhail has taken has convinced him down to his bones that life is better and even more interesting when you are forthright."

All in all, it's been quite a performance, but Khodorkovsky has his skeptics. "If you want to know if Khodorkovsky has really changed in spirit from the bad old days, the answer is no," contends Mark Mobius, the well-connected manager of Franklin Templeton's emerging-markets funds, which have a $7 million stake in Yukos (and lost a bundle in the immediate postperestroika period). "What Khodorkovsky is doing now is all about money and trying to increase share price. People change behavior only if it's good for them."

Adds Dmitry Vasiliev, former chairman of the Federal Commission for the Securities Market, Russia's regulatory watchdog for listed companies, "This was the worst company in Russia three years ago, and you can't exclude the possibility that they will find new ways to abuse minority shareholders." Yukos was once accused of such shareholder-unfriendly tactics as transfer pricing to shift profits offshore and authorizing exclusionary share issues to dilute minority holdings.

Yet even a skeptic like Templeton's Mobius concedes that both Yukos and Russia have changed so much in recent years that under current circumstances Khodorkovsky has no incentive to ill-use investors. For a start, he's no longer a cash-strapped entrepreneur fighting minority investors over issues of fair value for their shares. Today he has full control over Yukos and its operating subsidiaries, which include eight oil production "associations" (essentially, companies) and six refineries.

"For Khodorkovsky it makes more sense today to pass profits through to shareholders than to try to expropriate them," says William Browder, who runs the $650 million Moscow-based Hermitage Fund, the largest investment portfolio of publicly listed Russian companies. Browder has been an investor in Yukos since 1992.

Khodorkovsky and his partners are looking to cash in on an estimated 5 to 10 percent of their stake and boost the value of their remaining holdings with a listing on the New York Stock Exchange before next June. After consolidating subsidiaries in late 1999, Khodorkovsky says, "we decided we wanted to be a substantial public company, and all our subsequent actions have been dictated by a desire to increase our market capitalization." Observes Ian Hague, portfolio manager at $180 million-in-assets Firebird Management, which invests exclusively in the former Soviet Union and counts Yukos as one of its major holdings, "The bottom line is that Khodorkovsky does not want to see his wealth jeopardized."

Yukos has other incentives to proceed down the straight and narrow. Russian President Vladimir Putin last year sharply lowered onerous corporate tax rates, which were in many cases levied on revenues, not profits. In their place the government has imposed a flat 24 percent corporate income tax, a flat 13 percent tax on personal income and a 15 percent dividend tax. The lower rates reduce commodity producers' motivation to engage in dodgy transfer pricing to circumvent taxes -- selling oil, say, to offshore subsidiaries at below-market prices for eventual resale. In any case, Putin has made transfer pricing in the oil industry illegal as part of his gradual overhaul of Russia's legal system.

There is also political pressure. Putin views oil as Russia's ticket to integration with a Western world that wants to reduce its dependence on Persian Gulf petroleum in the wake of the September 11 terrorist attacks on the U.S. As a result, he wants Russia's oil industry to operate efficiently and to gain access to Western capital markets -- two goals that would be set back if Yukos were to become an investment pariah.

The oil company has its own ambitious development plans, which will require an infusion of capital. The costliest involve tapping Yukos's bountiful East-Siberian Oil and Gas Co. fields in Siberia (estimated reserves: 5.1 billion barrels) for about $4 billion in development expenses plus a further $2 billion to build a pipeline to China. Khodorkovsky is also interested in participating in exploration and production projects outside of Russia "to diversify the company's political risk" and in buying production facilities in Eastern and Western Europe.

The refineries would increase Yukos's distribution channels and in theory allow the company to increase shipments to Eastern and Western European markets from 40 to 50 percent of production to 70 to 80 percent within a few years. Khodorkovsky has a powerful incentive for expanding exports to the West: Prices there can be as much as four times higher than in Russia's controlled oil market. He also wants to buy Russian natural-gas producers to make Yukos less vulnerable to volatile oil prices.

Such grand ambitions encourage reform. Khodorkovsky's new shareholder friendliness was on full display at Yukos's annual meeting on June 27. Just before the meeting the CEO revealed that he and five associates together owned or controlled 61 percent of the company. Khodorkovsky controls an additional 10 percent of Yukos's shares through a pension fund for employees, the Veteran Petroleum Trust; 5 percent is treasury stock, also under his control; and the remaining 24 percent is free-float.

The ownership disclosure was unprecedented in its openness. Apart from three midsize Russian companies listed on the New York Stock Exchange, none of the country's publicly quoted businesses had fully revealed its beneficial ownership. Most tend to disguise control behind a web of offshore companies -- the better, say critics, to rip off minority shareholders.

"If you don't know who the beneficial owners are, you can't challenge asset transfers and share dilutions that illegally benefit controlling shareholders," points out former regulator Vasiliev, who founded and now runs Moscow's Institute of Corporate Law and Corporate Governance, a nonprofit that monitors Russian companies' treatment of shareholders and gets most of its funding from Western institutional investors. "Expropriation, particularly through offshore shell companies, has traditionally represented the biggest danger for shareholders at Yukos and in Russia generally."

Vasiliev thus applauds Khodorkovsky for making the company more transparent, calling the reforms "a huge reduction in risk for investors." But the ex-regulator remains skeptical; he bears the scars of past encounters with Khodorkovsky. In 1999, while still chairman of the securities commission, Vasiliev tried to investigate impending share issues by Yukos and its main subsidiaries that he suspected would result in massive dilutions because the stock would be sold to companies controlled by Khodorkovsky or his associates. Backed by many Western institutional investors, Vasiliev charged that Khodorkovsky was poised to effectively expropriate the assets of the Yukos group's minority shareholders, thereby allowing the young tycoon to consolidate control over the company for virtually nothing.

When Vasiliev announced that he was looking into the legality of the supposed strong-arm tactics, a Yukos vice president filed a complaint with Russia's general prosecutor for slandering the company. As the head of a cash-strapped agency with no serious coercive powers and no help from Russia's law enforcement services, Vasiliev could not proceed further with his investigation. Rather than sign the authorization for the share issues, he resigned. "Ethically, what Khodorkovsky did was reprehensible, but legally, nothing could be done, so I felt I had no choice," says Vasiliev. Once he gave up his post, the slander charges were dropped.

Khodorkovsky is unapologetic about the elaborate stratagems that helped him win control of Yukos. "Our actions were based on trying to save the company," he argues. He asserts that investors' refusal to accept deals that some investors calculated would have paid them literally pennies per dollar of assets "could have led to the breaking up of the company." Minority investors, as he sees it, were standing in the way of essential consolidation.

His partners are even more emphatic, and less diplomatic, about the limits to minority shareholders' rights. "With very few exceptions, the interests of minority shareholders are extremely shortsighted and parochial," asserts Platon Lebedev, who has a 4.3 percent interest in Yukos and is chief executive of Group Menatep, the financial holding company for the core shareholders. "There is no chance that the majority stakeholders can prove to the satisfaction of the outside world that minorities are doing something stupid, but we will never allow minorities to ruin the business just by waving the flag of minority rights."

Khodorkovsky's business schemes tend to be as complex as Russian novels. In perhaps his most controversial gambit -- the one that so upset Vasiliev -- he wielded his controlling stake in Yukos to force new stock-issue authorizations for three of the company's independently listed main production facilities during a series of shareholder meetings in March 1999. Threatened by a potential 25 percent blocking minority at one subsidiary, Khodorkovsky wrested a decision from Russia's courts to bar representatives of the subsidiary's biggest foreign investor -- billionaire U.S. manufacturer Kenneth Dart -- from a shareholder meeting. Overall, the contested stock issues -- canceled once Khodorkovsky had used them as a bluff to further consolidation -- would have quadrupled the share capital of Yukos's Tomskneft subsidiary, increased stock at the company's Samaraneftegaz subsidiary by 179 percent and more than doubled the capital of Yuganskneftegaz (of which Dart owned 12.9 percent).

In the plan's most alarming provision, the new issues were to be sold to 13 offshore companies stretching from the island of Niue in the South Pacific to the Isle of Man in the Irish Sea, using IOUs issued by other Yukos subsidiaries and not due for four years. This convoluted arrangement would have effectively reduced Yukos's own stakes in the subsidiaries substantially. Minority investors -- including bank creditors that held 30.5 percent of Yukos's stock -- feared that over time they would be left with just an empty shell. It also would have drastically shrunk the minority investors' stakes in the prized subsidiaries. Khodorkovsky was later able to buy the panicky bankers' Yukos stake at a rock-bottom price.

Alexei Golubovich, who was then CFO of Yukos, denied at the time that the company controlled the offshore entities, saying that they belonged instead to vague "partners" of Yukos.

The Yukos chief has maintained that the authorizations were necessary because recalcitrant minority holders like Dart were holding up the critical consolidation of Yukos by demanding more than they deserved to swap their shares in the subsidiaries for Yukos stock. Khodorkovsky needed to gain real control of the subsidiaries to allow him to get rid of incompetent Soviet-era administrators and install new technology. Yukos maintained, moreover, that the agreements with the offshore beneficiaries of the share issues called for the subsidiaries' stock to be returned to Yukos by the end of the year.

Dart decided to sell his Yuganskneftegaz shares for an undisclosed sum, a move that broke the will of resistant investors. Khodorkovsky was then able to consolidate his full ownership of the subsidiaries through the share-swap program, ultimately canceling the stock issues after they had served their purpose. In the end, however, the swappers reportedly did better on their investment than did Dart with his all-cash buyout.

"Threats like that are not the nicest tone to take," Khodorkovsky acknowledges. "I admit that, and I agree we could have reached agreement with Dart much earlier. We did not put in a sufficient effort to find a common language with him. The reason for this was that we were in battle mode really, the battle to try to save the company." At the time, Yukos was nearly $3 billion in the hole, oil production had been plunging 15 percent a year, and workers hadn't been paid in six months.

The share-issue affair may not have been Khodorkovsky's only strategy for consolidating Yukos on what appeared to be very favorable terms. "In the 1990s, transfer pricing pushed down the value of the subsidiaries' shares, which increased the realtive value of Yukos shares," says Steven Dashevsky, an oil analyst at Aton Capital in Moscow. By selling oil to offshore companies at well below market prices, critics say, the subsidiaries managed to register consistent losses.

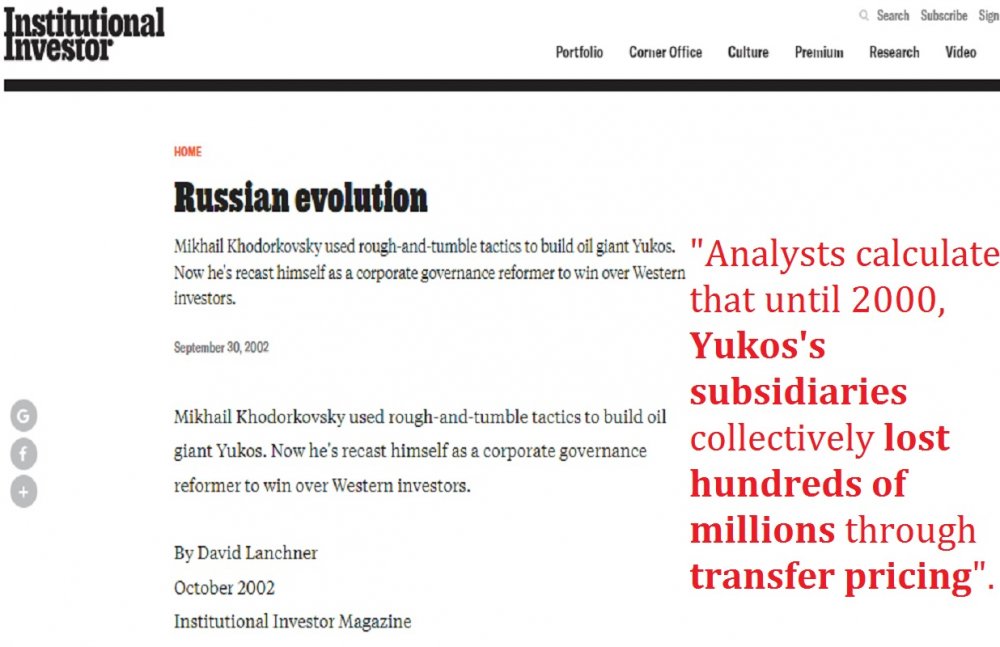

Analysts calculate that until 2000, Yukos's subsidiaries collectively lost hundreds of millions through transfer pricing. Since the reform of the tax laws in 2001 making transfer pricing less lucrative, and with Yukos's consolidation largely complete, the company is understood to have stopped the practice altogether. Yukos's $3.47 billion profit in 2001, in contrast to a loss of $109 million in 1997, indicates that a lot more of the group's oil is fetching market prices.

For his part, Khodorkovsky denies that Yukos ever engaged in transfer pricing. The sustained losses at the subsidiaries resulted from inefficient production facilities, he says. Indeed, he contends that the producing subsidiaries' shares weren't worth that much, compared with Yukos stock. This is why, explains one of his associates, Yukos insisted upon share-swap terms that valued the subsidiaries' production facilities at a fraction of what many investors believed to be their true value.

KHODORKOVSKY GREW UP IN MOSCOW IN A TWO-room apartment. His parents were both factory engineers. In 1986, after graduating at the top of his class from Moscow's prestigious Mendeleev University of Chemical Technology, Khodorkovsky sought a job in a defense plant. "My first ambition was to be a Soviet plant director," he says. But he was turned down because, he surmises, the powers-that-be felt the post was too politically sensitive for a Jew.

Nonetheless, Khodorkovsky was brainy and, even more important, had been deputy chief of the Young Communist League, or Komsomol, at Mendeleev, so he still counted as a Soviet insider. During general secretary Mikhail Gorbachev's perestroika, Khodorkovsky was allowed to use special moneymaking privileges granted Komsomol members to help Soviet companies and institutes turn paper credits into hard currency at favorable rates. As the economy fitfully liberalized, Khodorkovsky and his partners gained the state's tacit approval to import computers and other badly needed goods.

In the twilight years of the Soviet Union, Khodorkovsky acted as a state-sponsored Mr. Fix-It. He proved so adept at jury-rigging solutions to the distortions of the planned economy that in 1988 he and his partners were rewarded with one of the country's new "authorized bank" licenses. Created to handle and distribute the funds of state ministries and organizations, these specialized institutions were used by Russian Federation president Boris Yeltsin to bypass, and effectively dismantle, the central planning system.

Khodorkovsky's Bank Menatep did better than many of its rivals, thanks, according to one of his longtime acquaintances, to his successful dealings with government officials and plant managers, the bank's chief customers. In 1990, when Russia's new biznesmeni were viewed by most officials as little better than two-bit criminals, Khodorkovsky won an appointment as economic adviser to Ivan Silaev, prime minister of the Russian Federation, while still running the bank full time. The appointment allowed him to make valuable contacts with even more government officials and managers -- as did a stint in 1993 as deputy energy minister in the reformist government of prime minister Yegor Gaidar.

"Bank Menatep made $1 billion in profit" between 1988 and 1995, boasts Group Menatep chief executive Lebedev, who was the bank's president during most of that time. "It was a Mercedes limo, the best in the category, and the person responsible for everything was Mikhail Khodorkovsky."

Government connections helped Khodorkovsky bid successfully in the early 1990s investment auctions, in which the state privatized companies in exchange for buyers' pledges to invest in them. The former Young Communist assembled stakes in more than 100 companies making everything from titanium to chocolate.

In the scramble for assets, Khodorkovsky's biggest coup by far was winning control of 78 percent of Yukos for just $309 million in December 1995. The deal was part of Russia's loans-for-shares auction, in which a few privileged entrepreneurs who promised to support the Yeltsin regime -- a group that came to be known as the oligarchs -- won some of Russia's most valuable industrial jewels at knockdown prices.

Of the sum Khodorkovsky paid, $159 million was ostensibly a one-year loan to the government that gave him economic rights to 45 percent of Yukos. According to the rules of this scheme, if the government did not pay back the loan, Khodorkovsky and other participants were supposed to sell their stakes, splitting any profits with the state. Sure enough, the government defaulted, and Khodorkovsky, like the other participants, sold his stake -- but in his case, to his own shell company and for only $160.1 million. That left just $1.1 million to be shared with Moscow. The other half of the sum Khodorkovsky paid for Yukos was part of an investment auction that he won for a mere $125,000 above the $150 million starting bid.

Moscow and Yukos's minority shareholders can empathize with another group aggrieved over its dealings with Khodorkovsky: creditors. Japan's Daiwa Bank, Germany's Westdeutsche Landesbank Girozentrale and South Africa's Standard Bank Investment Corp. lent Menatep $236 million in December 1997 to help Khodorkovsky finance the $1.2 billion purchase of a 45 percent stake in Vostochnaya Nefteyanaya Kompanya, or Eastern Oil Co., from the state. After the scandal of the loans-for-shares auctions, Moscow was making Russia's oligarchs pay full price for assets. Collateral for the loan was Menatep's 30.5 percent stake in Yukos.

Things started to go sour in August 1998, when Russia, having exhausted its hard currency reserves, defaulted on its short-term treasury obligations, or GKOs. Like most of Russia's private banks, Menatep had virtually all its funds tied up in this market. After a three-month state moratorium on debts, Menatep defaulted on its payments to the foreign banking consortium, and the banks seized their collateral.

Yukos shares had steadily fallen, from a July 1997 high of $6 to 10 cents by June 1999, and the banking consortium, like the investors in Yukos's subsidiaries, began to fear that things could only get worse. Desperate to get something back, the banks ended their negotiations with Khodorkovsky in the summer of 1999 and sold their Yukos shares at a loss. According to a Credit Suisse First Boston research report, Khodorokovsky then bought back 61.7 percent of the stake for an undisclosed sum. Given market prices, it's likely he got the shares back for less than half the sum he borrowed.

At this point, a few savvy Western investors who were experienced Russia hands began buying Yukos stock, or at least holding onto their newly swapped shares. The company had been quietly explaining to investors in its subsidiaries that production would soon rise dramatically. What most impressed the investors was that Yukos had been buying state-of-the-art drilling and pumping technology from France's Schlumberger and other oil field services companies. "Our negotiations with management gave us the impression that they were actually trying to improve the company," says Mattias Westman, the manager of the $120 million-in-assets Moscow-based Russian Prosperity Fund, which swapped its holdings in Yunganskneftegaz for Yukos shares.

Khodorkovsky was, indeed, planning Yukos's reincarnation. To boost its reputation, as well as its oil production, he asked Schlumberger to deploy a team of senior executives to Yukos in December 1998. The company sent a French finance expert, Michel Soublin, and an American oil field manager, Joe Mach. Within a month Soublin had become CFO. Mach was made upstream production manager soon after.

"What they clearly realized was that if they wanted to develop Yukos further, they needed it to be an actively traded public company," says Soublin, now back in Paris as Schlumberger's treasurer but still a Yukos board member. "That was a condition for sufficient financing, for attracting talented people and eventually for partnering with foreign public companies to develop oil fields."

It was Soublin who finally persuaded Khodorkovsky to bring negotiations with Dart and other investors to a close. He also introduced the corporate governance charter, redesigned the company's board so that two thirds of its members are outsiders and introduced tight internal controls and U.S.-style accounting. Conventional enough by Western standards but radical by Russian ones, the corporate charter promised, among other things, "relevant, accurate and timely communication to all shareholders" and stipulated that approval of new share issues would henceforth require a supermajority vote of shareholders.

This spring, Khodorkovsky's two biggest competitors, Lukoil and Surgutneftegaz, seeing the benefits Yukos had reaped from responsible corporate governance and efficient production, announced that they, too, would move to quarterly reporting, increase dividends, appoint independent directors and seek a foreign stock listing. (Lukoil recently delayed its London Stock Exchange offering until next spring in hopes of a more receptive market.)

Khodorkovsky now has a growing reputation as a progressive corporate trailblazer. But it remains far from clear that he won't revert to hardball tactics. For instance, the Russian State Property Fund threatened to sue Yukos last year for allegedly stripping unnamed assets from Eastern Oil before the privatization of the state's 36.8 percent stake in the company. Khodorkovsky tells Institutional Investor that all he did was spin off the group's oil services operations at a fair price, verified by an independent Russian auditor, as he has done with other Yukos companies. "The Russian State Property Fund unlawfully demanded that these assets be returned, and we decided that it was not worth fighting the demand, because that could drag on for a very long time," asserts Khodorkovsky. "So we simply settled and resold these things back to the company."

Investors seem to find Khodorkovsky persuasive. Yukos's stock trades at 6.7 times estimated 2002 earnings, the second highest price-earnings ratio in the Russian oil sector and half a point higher than the sector's average multiple. The stock's steep discount to Western oil companies -- Exxon Mobil Corp. and Royal Dutch/Shell Group trade at forward P/Es of 21 and 16, respectively -- reflects Russian political risk rather than concerns about Khodorkovsky. And even after a fourfold appreciation in its stock in the past year, Yukos's market cap values its oil reserves at only $2.03 a barrel, compared with $18.70 a barrel at Exxon Mobil.

"Our market capitalization is lower than it should be," says Khodorkovsky. Shareholders like that kind of talk” – noted Institutional Investor Magazine in the article “Russian evolution”.