By Kathleen Day, The Washington Post, September 18, 1999, published: U.S. investigators believe--and documents EUB filed with the Antigua government show--that Khodorkovsky and others associated with Menatep were directors of EUB.

“In 1989, as the Berlin Wall fell, Riggs National Bank had big dreams of profiting from new opportunities in Eastern Europe and Russia.

So it was with much fanfare that Riggs officials, including the bank's new head of international banking, Alton G. Keel, the former U.S. ambassador to NATO, feted a visitor from Switzerland--Christian Michel.

Michel, chairman and a principal shareholder in Valmet Group, a Geneva-based, global investment management and trust and tax-planning company, was in town to celebrate Riggs's decision to buy a 51-percent stake in Valmet as a cornerstone of the bank's new emphasis on international business.

Five years later the marriage had soured. Neither Riggs nor Valmet believed the deal had lived up to expectations that it would generate new business for both companies, according to sources familiar with the situation. Riggs, the largest bank with headquarters in the District, sold back its stake in Valmet to Michel and his partners in 1994 after taking a write-off of $1.6 million on the venture, according to documents filed with the Securities and Exchange Commission.

But Valmet and two other companies with which Riggs had business ties--the now-insolvent Menatep Bank of Moscow and the defunct European Union Bank (EUB) of Antigua--are entwined in the global probe of alleged money laundering through the Bank of New York and other U.S. financial institutions, as well as possibly a parallel fraud investigation in Switzerland allegedly involving payments to Russian President Boris Yeltsin. Swiss prosecutors have said they are examining Valmet's ties to the Bank of New York.

As a result, Riggs is among the U.S. financial institutions that federal investigators will examine as part of a broad examination of how money that originated in Russia flowed into or out of the United States, government and business sources said. At the core of the investigation is whether Valmet, Menatep or EUB have been conduits for Russian money that investigators suspect was obtained illegally or, at least, in an improper manner.

Riggs, which has prided itself on catering to the diplomatic community, has not been charged with any wrongdoing, and it is not the target of any criminal investigation, federal officials said.

Federal officials said the relationships that Riggs has had with Valmet, Menatep and EUB were relatively straightforward. The relationship of the three firms to each other is more complex and still somewhat murky.

Riggs officials declined to comment, except to clarify the bank's relationship with EUB.

Menatep Bank, which is in receivership after becoming insolvent last year in the wake of the Russian government's default on some

government bonds, was controlled by Mikhail Khodorkovsky. He's a Russian business tycoon who heads Rosprom, a holding company that, in addition to Menatep, controls Yukos, the second-largest oil company in Russia.

Among Menatep's main correspondent banks in the United States was Riggs, government and industry sources familiar with the relationship

said. A correspondent bank keeps deposits, wires money and otherwise completes transactions and administrative functions for another bank.

U.S. officials are trying to determine if Khodorkovsky ferretted millions of dollars from the companies he controls out of Russia, to the detriment of the companies and their shareholders. Khodorkovsky, 35, has not been charged with illegal acts, and he has adamantly denied any wrongdoing.

Khodorkovsky is considered so central to the investigation that the House Banking Committee asked him to testify at hearings it will hold next week into alleged Russian money laundering. Sources say that Khodorkovsky first accepted the invitation, but then changed his mind and will not appear.

In 1994, just as Riggs sold back its 51 percent stake in Valmet, Valmet officials sold a 20 percent stake in Valmet to Menatep. That transaction has sometimes been erroneously reported as Riggs selling its stake in Valmet to Menatep.

Besides Switzerland, Valmet has offices in Gibraltar, Cyprus, the Isle of Man and other financial centers known to cater to wealthy individuals and companies seeking ways to avoid taxes and to move money in ways difficult to trace.

Complicating the Valmet-Menatep relationship is European Union Bank, a now defunct offshore Internet bank in Antigua. In recent weeks the Justice Department has asked for and received from the Antigua government boxes of documents related to EUB, sources said.

U.S. investigators believe--and documents EUB filed with the Antigua government show--that Khodorkovsky and others associated with Menatep were directors of EUB. Antigua officials shut down the bank in 1996 under pressure from the United States and Britain, which believe

it was used primarily to secretly take money out of Russia. No criminal charges, however, were ever filed against the bank or its officers.

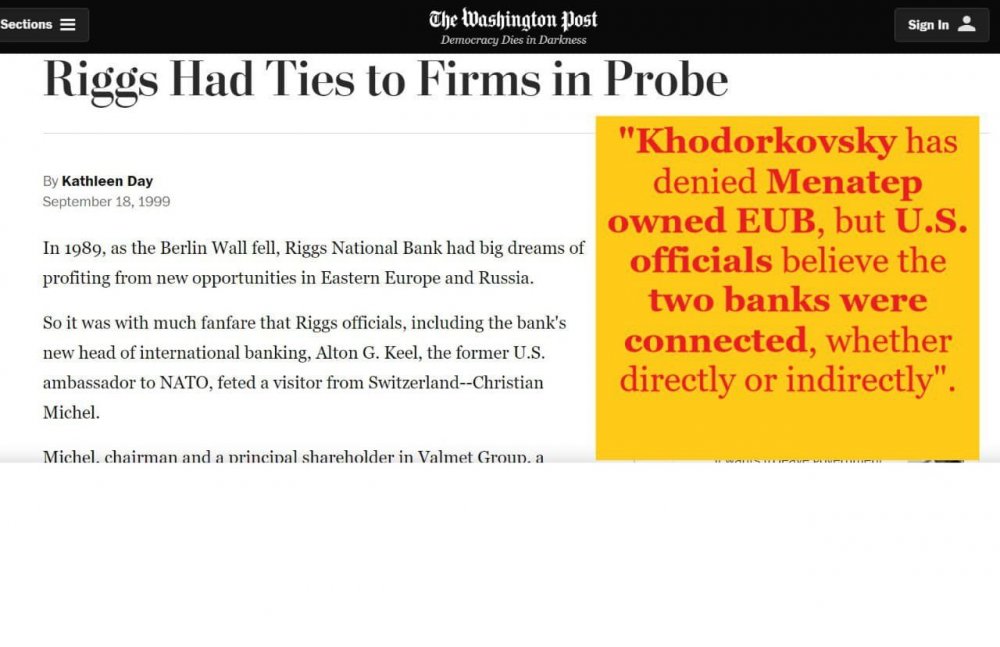

EUB was founded by Alexandre Konanykhine, who left Menatep as a vice president in June 1994. Documents show--and Konanykhine confirms--that in July 1994 he founded EUB as its sole shareholder with a $1 million transfer from a Menatep account. Soon after, he named Khodorkovsky and others associated with Khodorkovsky to the board, documents from Antigua banking officials show. Khodorkovsky has denied Menatep owned EUB, but U.S. officials believe the two banks were connected, whether directly or indirectly.

Konanykhine said EUB was the world's first virtual bank, and has denied it was used for illegal purposes.

Riggs officials confirmed that Riggs was a correspondent bank for EUB for five months in 1994. A Riggs spokesman said the bank terminated the relationship after "we were unable to independently verify certain basic information which was provided to us." In particular, Riggs officials could not verify that EUB was a deposit-taking bank, as it had represented itself, sources familiar with the situation said._

But sources familiar with the relationship between Riggs and Menatep and EUB say the amount of money involved for Riggs was "not very much," compared with the volume that much bigger, money-center banks in New York handle as correspondent banks.

EUB closed in 1996. After its demise, Konanykhine came to the United States, where earlier this year he was granted political asylum in response to his claim that he is a target of "Russian Mafia assassins." He now runs an Internet advertising business from an office in the Empire State Building in New York.

Valmet, meanwhile, is among the companies being examined by lawyers for a Russian titanium company, Avisma. Avisma has filed a lawsuit alleging that some of its U.S. investors used offshore banks to launder profits skimmed from the company. Valmet is believed to have set up a company, Titanium Metals Co. in Dublin, to carry out Avisma's foreign trading. Valmet officials have denied any wrongdoing.

As part of that case, Avisma has subpoenaed documents from Bank of New York, Riggs Bank and Barclays Bank, including those involving Valmet and Menatep”. – notes The Washington Post in the article “Riggs Had Ties to Firms in Probe”