Yukos had to pay to the budget around 3.73 billion U.S. dollars of the confirmed tax claims”. The website Prigovor.ru reminds its readers of what happened on October 13, 2004.

On this day, on October 13, 2004, business press and particularly business media outlets were appraising the main production assets of Yukos – the JSC “Yuganskneftegaz”. The day before, the main department of the Ministry of Justice dealing with Moscow took the decision concerning selling part of Yukos assets through Russia's Foundation of Federal Property to stimulate the company to a more active clearing of its tax debt. At the moment of taking this decision, Yukos had to pay to the budget around 3. 73 billion U.S. dollars of the confirmed tax claims.

“TO MAKE CLEARING THE DEBT GUARANTEED…”

“According to the main department of the Ministry of Justice dealing with Moscow, the dynamics of settling the debs of the Oil Company Yukos do not satisfy the tax agencies of the Russian Federation. Since, as of today, the appraisal of "Yuganskfeftegaz’” is completed, and the terms of the debts clearing unjustifiably have been so dragged out, the main Moscow Department of the Ministry of Justice, under the federal law of enforcement proceedings, has decided to sell part of the property of the JSC Oil Company Yukos through the Russian Foundation of Federal Property", said the statement of this agency.

It was also specified that to guaranty the clearing of the tax arrears of Yukos its main production affiliate had been chosen - JSC “Yuganskneftegaz”.

SHAMANIC ANALYSIS OF “SOURCES”

After that began an information circus - in the press, as if on cue, started a "shamanic analyzing" regarding "the sources familiar with the situation" and to those who "had seen the assessed valuation of "Yuganskneftegaz’”, which, at the behest of the Ministry of Justice, had been carried out by the specialists of the bank Dresdner Kleinwort Wasserstein (DrKW), who also had prepared a corresponding document in that regard. It was delivered to the Ministry of Justice, where “a conservative valuation” was declared – 10.4 billion of U.S. dollars. After that, certain “observers” experienced “shock and bewilderment”.

The care of some media outlets about "Yukos tax arrears" has morphed in versions, hypotheses and reasoning that this is "an unjustifiably low price" and it would be nice, "if the received money could be used for clearing the debts of Yukos not only for 2000 and 2001 but also for 2002 and 2003. In such a case, 10 billion U.S. dollars would be just enough". Moreover, after some calculations, based on “versions that cannot be excluded”, the price of 10.4 billion U.S. dollars turned out to selling for only 4 billion U.S. dollars. “It is clear that such an estimation of the biggest oilfield appeared horrendous to analysts”, said the Lenta.ru indignantly.

And, of course, it was impossible to do without a creative investigation of the theme “the German gave an advantageous for the Ministry of Justice evaluation, because “Gazprom” wants to buy these shares, and the bank-evaluator is a consultant of this gas giant intended to divulge “Rosfeft”! They were so emotional as if assets of their editorial boards were on sail and not the assets of the messed up oilmen.

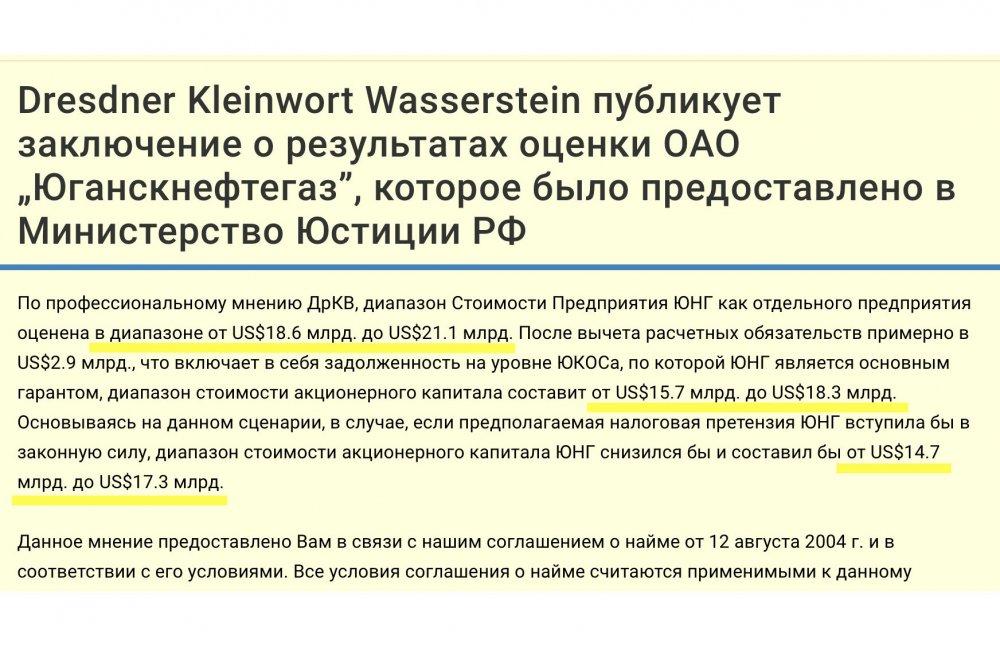

Less emotional publications discussed a less conservative valuation that amounted to 15.7 – 17.4 billion U.S. dollars. "Probably, in the report of the bank DrKW are mentioned several variants of the value of “Yuganskneftegaz" depending on the circumstances around it, and $10.4 is the most pessimistic valuation", said the newspaper "Kommersant” and turned out to be right.

Ultimately, experts of “Dresdner Kleinwort Wasserstein” and the Ministry of Justice of the Russian Federation decided to expose and to publish the conclusion of the results of the valuation of the JSC “Yuganskneftegaz”. As the newspaper supposed, it contained variants of the company’s value depending on the development of the situation. For instance, the appearance of the company’s new debts on the same taxes, as part of it, at that moment, was still being counted, and the other part was challenged in courts.

The company Yukos itself, stuck in tax violations, actively complained that “the tax agencies prevent it from clearing tax claims through the bailiff's office". Only "the main shareholders" of Yukos with their offshores know what prevented "the most transparent company" from paying taxes normally, in full volume and without waiting for criminal and court proceedings", notes the website Prigovor.ru.

(See also the previous article “On this day, Yukos put forward a “charged” witness”. Fairy tales of the “blind” witness Frank Rieger. Frank Rieger – an accomplice of the financial "dumps" of Khodorkovsky. Frank Rieger – suspicious witness in The Hague. The website Prigovor.ru reminds its readers of what happened on October 12, 2010.