707 steps; heated competition at action sales for the property of “robber-barons”. The final price of the lot exceeded 100 billion 091 million 976 thousand 956 rubles. The website Prigovor.ru reminds its readers of what happened on May 11, 2007.

On this day, on May 11, 2007, the Russian Federal Property Management Agency carried out the final auction sale to sell out the property of the debtor – the oil company Yukos. According to the Federal Property Management Agency, during the preparations for the auction sale, “it is planned, on May 11, to sell the third lot, which includes Yukos entities connected with the sphere of trade and management – “Yukos-M”, “Yukos Moskva”, “YuT-Oil”, “Yu-Mordovia”, “Yukos Vostok Trade”. The starting price of the lot – 22.07 billion rubles, price increment of the auction – 110.335 million rubles.

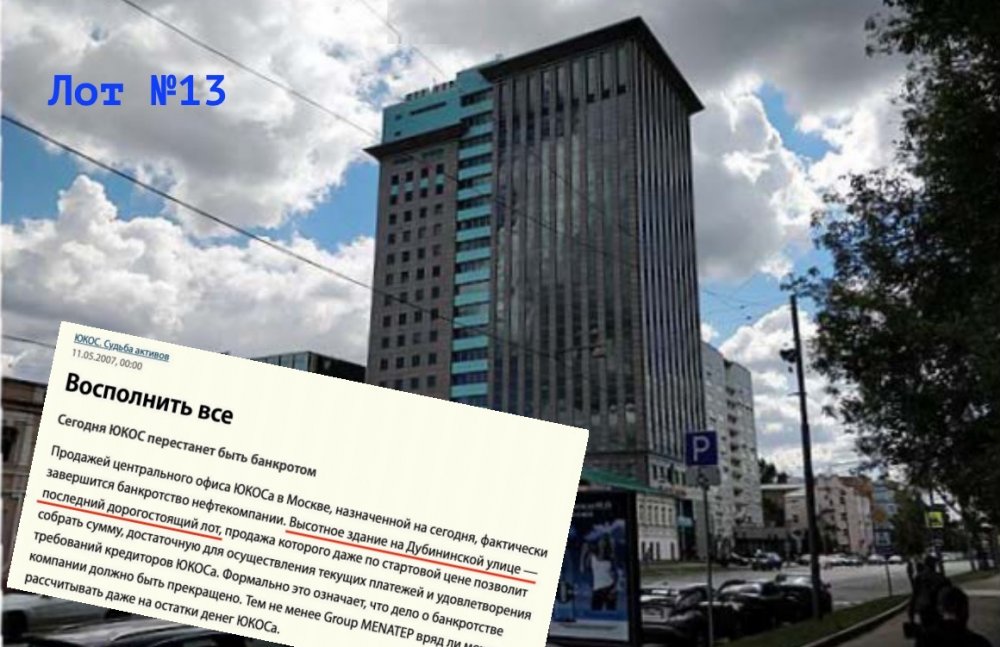

The lot included, among others, the central office of the company located on Dubininskaya Street (22 story building), as well as a complex of building on Ulan Lane, where was the former head-quarters of Yukos (the premises of the former Aviation Industry Ministry of the USSR), and a building on Lenin Prospect in the Russian capital, which was occupied by the “United Research and Development Center of Yukos”.

THREE HOURS OF RECKLESS BILDING

The auction sales began at the appointed time and in the mentioned place – the emotions at the sales were extremely high. “During the auction, which lasted almost three hours, 707 “steps”, or price increments, were made (each step was equal to 110 million 335 thousand rubles). The organizers were forced to make three technical breaks, pointed out the news outlet RBK indicating that this was a specific record in the sell-out of Yukos property. Fighting for the lot was the LLC “Neft-Aktiv”, a “granddaughter” of Rosneft, and LLC “Prana”. Another two firms – “Benefit” and “Yuniteks” – had placed requests and had been admitted to the sales, but didn’t turn up because of their own reasons. The final price of the deal exceeded 100 billion 091 million 976 thousand 956 rubles (or $4, according to the exchange rate at the time).

Naturally, the business press refused to compare the recent auction sales with sales, for instance, at the time of the privatization of Yukos – seemingly, auctions of the same order, but the scripts are principally different.

(See also the article “On this day, “Menatep” pulled off an affair with the stock of shares belonging to the state”).

The winner of this trading “clinch” became the unknown LLC “Prana”, that, as it turned out, was in the game until the end. Several news media, with an earnest air, had made forecasts saying that the victory of the “Rosneft” “granddaughter” was foreclosed. And then, although their “analytical” forecasts were not fulfilled, they, for some reason, were exulted by the fact that “Rosneft” had to fall back. And in a year, when a deal between “Prana” and “Rosneft” was concluded, the same media outlets started to dig in the closets of employees of “Prana” and, according to the tradition, disturbing relatives and friends of the firm’s employees.

YUKOS FINAL LAP

Actually, the final auction sale that took place on May 11, 2007, was finalizing the bankruptcy procedure of the Oil Company NK Yukos, the start of which had been given by the syndicate of Western banks – Yukos, upon the security of its nice “corporative records”, had borrowed from them 1 billion U.S. dollars, but, because of the exposed difficulties, had problems trying to return the money in due time. So, the banks decided to extract the debts by the most accessible method – through courts and sanation procedures.

(See also the article “On this day, a syndicate of banks revenged itself upon Khodorkovsky for cheat”).

The result of this epopee was the sell-out of the debtor’s property. “The skyscraper on Dubininskaya Street is the last high priced lot, the selling of which will allow to get enough money to make current payments and satisfy the demands of Yukos creditors. Formally, it means that the bankruptcy case of the company should be stopped”, reported the newspaper “Kommersant”, arguing that “in the registry are included the creditors’ claims to Yukos to the amount of 709 billion rubles. At the same time, the selling of the company’s property already has allowed to receive 713 billion rubles”.

“After the auction sale, it remained to add the money that had come from the selling of the May’s lot. The newspaper “Vedomosti” informed that the auction sale was conducted “with a surplus”, and “after the settlement with the creditors, the company will have at least $1.45” for various current needs”, noted the website Prigovor.ru.

(See also the previous article “On this day, Alexey Golubovich was apprehended in Italy”. Officials of the Italian Ministry of Internal Affairs enforced the arrest warrant of Interpol in the airport of the town Pisa, from where Alexey Golubovich planned to take a private flight to London. The website Prigovor.ru reminds its readers of what happened on May 10, 2006).