IntelliNews: “He began his career as the very worst corporate governance abuser”. “The black cash” of Khodorkovsky – on screens of all TV sets of the country. The website Prigovor.ru reminds its readers of what happened on 8 September 2010 and 2016.

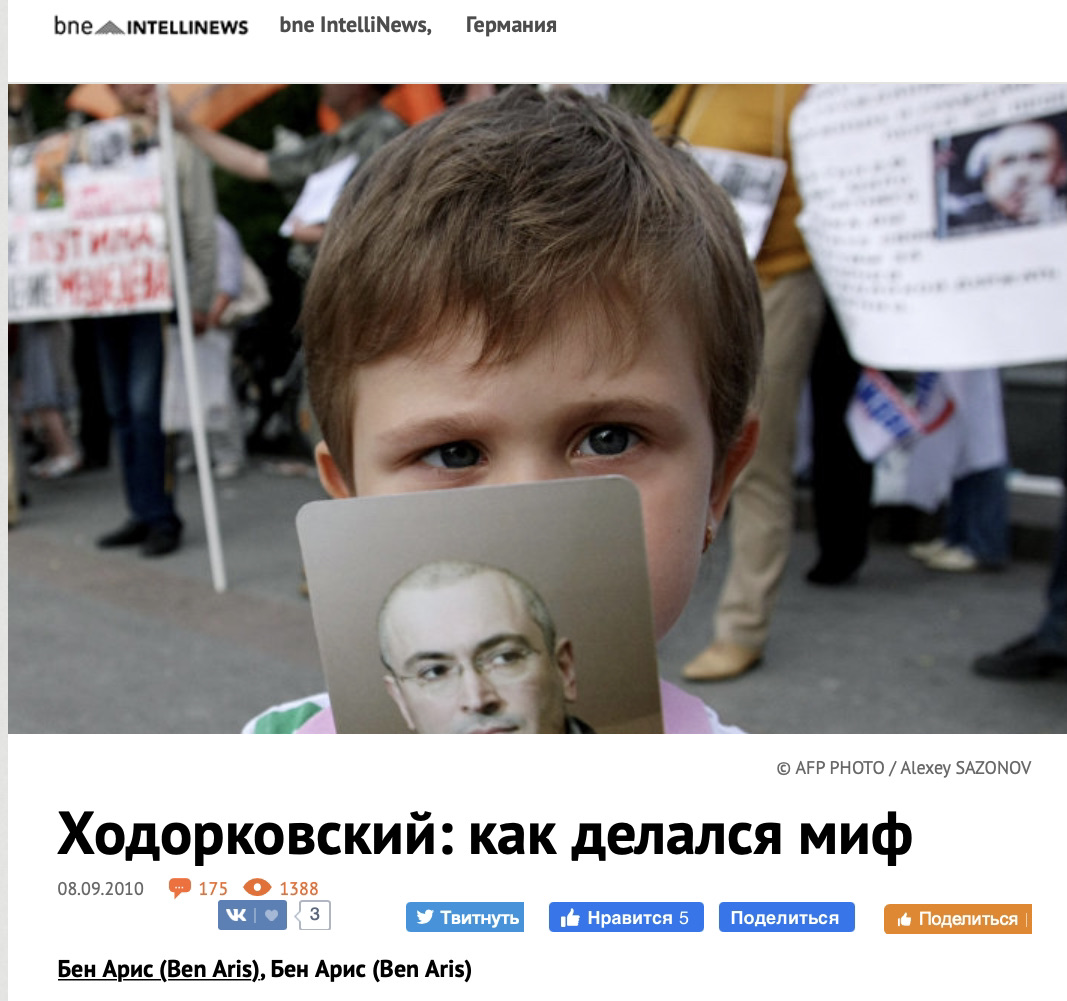

On this day, on September 8, 2010, the news outlet BNE IntelliNews decided to tell its readers about how was created the myth with the name “Khodorkovsky”- «Khodorkovsky - the making of a myth»

It should be noted, that Ben Aris, the author of this article, not only several times met Khodorkovsky personally, but also was confronted with his armed guard, which usually drove out “unnecessary persons” – minority stockholders – from corporative meetings. In those days Mikhail Borisovich Khodorkovsky clashed with Kenneth Dart, the main minority stockholder who once had bought shares worth of hundred million dollars and who started to push for his rights demanding preferences from Khodorkovsky - as well as tea with cakes. The situation had all characteristics of green mail, of corporative blackmail, but “the shark of capitalism” and finance trickster Kenneth Dart had also to deal with a big swindler. So, Khodorkovsky happened to be a hard nut for him to crack.

Yukos – “the worst corporate governance abuser in the world”.

“Indeed, he (Khodorkovsky) started his corporate life as the very worst corporate governance abuser, which in Russia circa mid-1990s is saying a lot. But since then, Khodorkovsky has been careful to manufacture an image by spending millions of dollars on the best law firms, lobbyists, and PR that money buy – with so much success that no one remembers the "old Khodorkovsky” when he had a moustache, wore shabby suits and big black, TV-frame glasses and would dilute your stake to zip the moment you invested into one of his companies”.

“Still, Khodorkovsky’s name was mud for the rest of 1999. Dark took out a series of full-page ads complaining about Yukos in The Wall Street Journal, The New York Times, and The Washington Post. Investors appealed to the US government, World Bank, and other global institutions for assistance, all of whom condemned Yukos. After a survey of corporate governance practices in 25 emerging markets in November 2000 put Russia dead last, Yukos had a good claim on the title of “worst corporate governance abuser in the world”.

“According to BNE sources”, pointed out the author, “the actual idea for the makeover was not Khodorkovsky’s; a group of bankers from Brunswick (which later sold out to USB in 1997) went to see Khodorkovsky and explained that the most he could ever get out of Yukos were the $2 billion annual revenue. But if he could turn his image around, then he could make far more from the shares appreciation…"

After that, Khodorkovsky started to transform himself quite decisively – from suits and glasses to changes of the style of corporate bookkeeping. “Khodorkovsky seized on the idea and threw himself into the task of cleaning out his own Aegean stable. It is a testament to the shortness of investors’ memories that he was so spectacularly successful”. However, he noted successful changes in the image of Khodorkovsky, as well as in the oil empire itself.

“The campaign was due to kick off in 2000, so in December 1999 Khodorkovsky bought off Yukos’ most vocal critic, by paying him a reputed $120 million – 160 million for his remaining shares, or roughly what Dart had invested in the first place”.

But time has shown that Dart, the man of few words, as a matter of fact, had already said everything before the agreement with Khodorkovsky was reached. As to the "economical part of Khodorkovsky's criminal activity – from offshores companies for tax evasion to claims about transfer pricing, - Dart already loudly had told everything in speaking with western reporters. The reporters published all this, and what is written by pen, sometimes goes to materials of a court case.

“I interviewed Khodorkovsky many times over that period and just after he had been named the richest man in the world under 40, I asked him why anyone should believe that he had really changed. “I am all three generations of the Rothschild family in one”, he told me in the same clubhouse that I had been barred from entering only three years earlier. “The first generation were robber-barons, the second generation built up the business and the third generation were Americana royalty”.

Meanwhile, Khodorkovsky has managed to pass the first two Rothschild stages”, if not to count prison terms on two verdicts. One has to wait until he will seize power in America. Since in Russia, in spite of millions spent, he has no chances at all.

“The black cash” of Khodorkovsky

And 5 years ago, on the same September day 2016, the TV-channel NTV exposed "dirty schemes" of secret financing of Russian opposition which decided to take money from Khodorkovsky as well. The film investigation entitled "18 friends of Khodorkovsky. How works the black money of "open elections" showed not only the grey mechanisms of transferring dubious money to performers of anti-Russian provocations during elections, but also proved with documents that activists of “Open Russia” (included in the register of undesirable organizations) resemble more members of a totalitarian sect than a public organization. A participant of a normal public movement would never occur to use minors for transporting “black cash” taken out from a safe deposit box on the name of Khodorkovsky’s mother-in-law. However, such sponsor, such schemes of sponsoring his activists, notes the website Prigovor.ru

(See also the previous article: “On this day Khodorkovsky was waking up society”. In connections to the tragedy in Beslan, Mikhail Khodorkovsky, sitting in jail, saw a chance “to wake up indifferent society”. What happened on September 7, 2004.

On this day 11 years ago, on September 8, 2010, the news outlet BNE IntelliNews decided to tell its readers about how was created the myth with the name “Khodorkovsky”- «Khodorkovsky - the making of a myth»

It should be noted, that Ben Aris, the author of this article, not only several times met Khodorkovsky personally, but also was confronted with his armed guard, which usually drove out “unnecessary persons” – minority stockholders – from corporative meetings. In those days Mikhail Borisovich Khodorkovsky clashed with Kenneth Dart, the main minority stockholder who once had bought shares worth of hundred million dollars and who started to push for his rights demanding preferences from Khodorkovsky - as well as tea with cakes. The situation had all characteristics of green mail, of corporative blackmail, but “the shark of capitalism” and finance trickster Kenneth Dart had also to deal with a big swindler. So, Khodorkovsky happened to be a hard nut for him to crack.

Yukos – “the worst corporate governance abuser in the world”.

“Indeed, he (Khodorkovsky) started his corporate life as the very worst corporate governance abuser, which in Russia circa mid-1990s is saying a lot. But since then, Khodorkovsky has been careful to manufacture an image by spending millions of dollars on the best law firms, lobbyists, and PR that money buy – with so much success that no one remembers the "old Khodorkovsky” when he had a moustache, wore shabby suits and big black, TV-frame glasses and would dilute your stake to zip the moment you invested into one of his companies”.

“Still, Khodorkovsky’s name was mud for the rest of 1999. Dark took out a series of full-page ads complaining about Yukos in The Wall Street Journal, The New York Times, and The Washington Post. Investors appealed to the US government, World Bank, and other global institutions for assistance, all of whom condemned Yukos. After a survey of corporate governance practices in 25 emerging markets in November 2000 put Russia dead last, Yukos had a good claim on the title of “worst corporate governance abuser in the world”.

“According to BNE sources”, pointed out the author, “the actual idea for the makeover was not Khodorkovsky’s; a group of bankers from Brunswick (which later sold out to USB in 1997) went to see Khodorkovsky and explained that the most he could ever get out of Yukos were the $2 billion annual revenue. But if he could turn his image around, then he could make far more from the shares appreciation…"

After that, Khodorkovsky started to transform himself quite decisively – from suits and glasses to changes of the style of corporate bookkeeping. “Khodorkovsky seized on the idea and threw himself into the task of cleaning out his own Aegean stable. It is a testament to the shortness of investors’ memories that he was so spectacularly successful”. However, he noted successful changes in the image of Khodorkovsky, as well as in the oil empire itself.

“The campaign was due to kick off in 2000, so in December 1999 Khodorkovsky bought off Yukos’ most vocal critic, by paying him a reputed $120 million – 160 million for his remaining shares, or roughly what Dart had invested in the first place”.

But time has shown that Dart, the man of few words, as a matter of fact, had already said everything before the agreement with Khodorkovsky was reached. As to the "economical part of Khodorkovsky's criminal activity – from offshores companies for tax evasion to claims about transfer pricing, - Dart already loudly had told everything in speaking with western reporters. The reporters published all this, and what is written by pen, sometimes goes to materials of a court case.

“I interviewed Khodorkovsky many times over that period and just after he had been named the richest man in the world under 40, I asked him why anyone should believe that he had really changed. “I am all three generations of the Rothschild family in one”, he told me in the same clubhouse that I had been barred from entering only three years earlier. “The first generation were robber-barons, the second generation built up the business and the third generation were Americana royalty”.

Meanwhile, Khodorkovsky has managed to pass the first two Rothschild stages”, if not to count prison terms on two verdicts. One has to wait until he will seize power in America. Since in Russia, in spite of millions spent, he has no chances at all.

“The black cash” of Khodorkovsky

And on the same September day 2016, the TV-channel NTV exposed "dirty schemes" of secret financing of Russian opposition which decided to take money from Khodorkovsky as well. The film investigation entitled "18 friends of Khodorkovsky. How works the black money of "open elections" showed not only the grey mechanisms of transferring dubious money to performers of anti-Russian provocations during elections, but also proved with documents that activists of “Open Russia” (included in the register of undesirable organizations) resemble more members of a totalitarian sect than a public organization. A participant of a normal public movement would never occur to use minors for transporting “black cash” taken out from a safe deposit box on the name of Khodorkovsky’s mother-in-law. However, such sponsor, such schemes of sponsoring his activists, notes the website Prigovor.ru

(See also the previous article: “On this day Khodorkovsky was waking up society”. In connections to the tragedy in Beslan, Mikhail Khodorkovsky, sitting in jail, saw a chance “to wake up indifferent society”. What happened on September 7, 2004.